Investor Confidence: VC Funding and the Nasdaq

(Map Credit) Venture capital invested as a percentage of gross metropolitan product.

(Map Credit) Venture capital invested as a percentage of gross metropolitan product.Top-10 Metro Ranking: 1. San Francisco 5.5%, 2. Seattle 2.7%, 3. Austin 1.8%, 4. Boston 1.5%, 5. Raleigh-Durham 1.4%, 6. Denver 1.2%, 7. San Diego 1.0%, 8. Grand Rapids 0.5%, 9. Wash. D.C. 0.4%, 10. Portland 0.4%.

This morning's Seattle Times ran a story indicating that venture capital fundraising among local VCs (Ignition, Madrona, OVP, Voyager, Fluke, Maveron and others) is strengthening, with institutional investors beginning to play a larger role alongside wealthy angel investors. In a broader sense, what does this trend tell us about equity investing and the stock market?

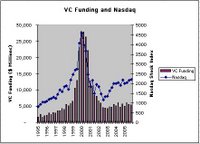

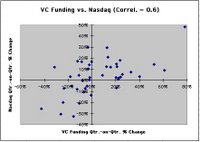

PWC's MoneyTree Report provides quarterly data on venture capital investment activity in the United States. The graph below to the left shows how the quarterly dollar amount of VC funding compares to the level of the Nasdaq stock index for the period from 1995 to 2005. Clearly there is a tight relationship between the tech bubble of 2000 and VC money chasing every variety of Internet deal around that time. The scatter plot to the right confirms the strong correlation (0.6) between quarter-on-quarter percent changes of VC funding and the Nasdaq over this 11-year period.

The MoneyTree Report for 2005Q4 includes a breakdown of VC funding by industry and company growth stage. As expected, the various technology sectors--particularly software, biotech, telecom, medical equipment, semiconductors and networking--received the bulk of the $21.7 billion in venture funding during 2005. Early stage ($3.4 billion in 747 deals), expansion ($7.8 billion in 1065 deals) and later stage ($9.7 billion in 952 deals) companies represent some 97% of the total. However, notably, between 2004 and 2005, startup/seed funding, although just 3% of the overall total, showed a very large percentage increase in new dollars invested, soaring 81% from $407 million in 2004 to $736 million (in 175 deals) in 2005, versus the largely unchanged grand total for VC funding as a whole.

Given the strong historical correlation between VC activity and performance of the Nasdaq, anecdotal evidence of renewed interest among institutional and individual investors in advancing capital to fund new ventures bodes well for the stock market. This is not to say that VC activity drives stock prices, nor vice versa. However, I would venture (pun intended!) to guess that the growing confidence private equity investors are showing in funding new ventures, particularly startups, is indicative of a broader sense of confidence in the larger public equity markets as well.

4 Comments:

Lloyd - I gather that you are a long-term investor and it is clear that you put a lot of analysis into your investments. If you don't mind me asking, what do you consider a reasonable annual return for your efforts? If you favor technology stocks, did you take a beating 2000-2003?

Good thinking! Please link to my site:

Investment Optimizer

The nasdaq has never recovered frome the dot com bubble of 2000.

Hello everyone, Are you looking for a professional trader, cryptocurrency/forex and binary manager who will help you trade and manager your account with good and massive amount of profit in return. you can contact Mr. Bernie for your investment plan, for he helped me earned $8,600 usd with little investment of $850 usd. Mr Bernie Doran you're the best trader I can recommend for anyone who wants to invest and trade with a genuine trader, he also helps in recovery of loss funds..you can contact him on his whatsapp: +1(424)285-0682 Email:(berniedoransignals@gmail.com)I advice you shouldn't hesitate He's great.

Post a Comment

<< Home