Looking for a Bottom in Mortgage REITs

(Drawing credit)

Mortgage REITs try to do more with less, leveraging shareholders' equity by borrowing multiples of core capital and investing all of the proceeds in mortgages, bonds and other debt secured by real estate. This leverage works wonders in years when yield curve spreads are favorable, and miserably when they are not. . . .

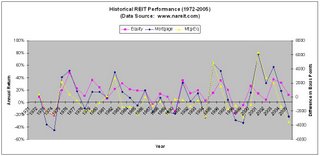

Among the various REIT sectors tracked by the National Association of Real Estate Investment Trusts (NAREIT), mortgage REITs were the worst performer during 2005, suffering a loss of 23%, compared to an average gain of 12% for all equity REITs (see performance statistics). So far this year, mortgage REITs continue to lag, trading flat through the end of February, versus a 9% gain for equity REITs. What's behind this underperformance of mortgage REITs and when might we expect a rebound?

Equity REITs have benefited from the lengthy bull market in real estate, and their stock prices recently have been lifted even higher by the keen interest private investment funds are showing in acquiring undervalued REIT shares and taking the publicly traded companies private (e.g., Blackstone Group buying office REIT CarrAmerica (CRE) for $5.6 billion). Mortgage REITs, on the other hand, are a different beast altogether. With their portfolios of mortgages instead of real property, mortgage REITs trade somewhat like leveraged bonds, showing more sensitivity to interest rates and the yield curve than to rents, occupancy and property operating income. Among the largest of the mortgage REITs by market capitalization are Thornburg Mortgage (TMA), New Century Financial (NEW), newly formed KKR Financial (KFN), American Home Mortgage (AHM), and Annaly Mortgage Management (NLY).

The graph to the right shows the annual performance of equity and mortgage REITs for the 34-year period from 1972 through 2005. Notice that returns of mortage REITs are considerably more cyclical than returns of equity REITs. Following four years of underperformance from 1997 to 2000, mortgage REITs showed spectacular gains for the three years from 2001 to 2003, producing returns averaging in excess of 50% per annum. Then, in 2004, mortgage REITs began to slip back into a funk, and by 2005 were lagging their equity REIT brethren by a wide margin.

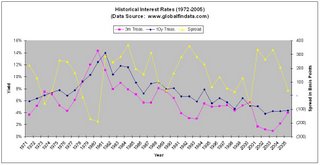

The graph to the right shows the annual performance of equity and mortgage REITs for the 34-year period from 1972 through 2005. Notice that returns of mortage REITs are considerably more cyclical than returns of equity REITs. Following four years of underperformance from 1997 to 2000, mortgage REITs showed spectacular gains for the three years from 2001 to 2003, producing returns averaging in excess of 50% per annum. Then, in 2004, mortgage REITs began to slip back into a funk, and by 2005 were lagging their equity REIT brethren by a wide margin. The cyclicality of mortgage REITs is due to the dependence of their underlying business on the yield curve. Managers of mortgage REITs typically leverage shareholder equity by borrowing additional funds short-term and investing into longer term debt instruments secured by real properties, similar to how banks and S&Ls run their deposit and lending businesses. Interest rate swaps and other financial derivatives may be used to manage yield curve risk, but mortgage REITs nevertheless show more sensitivity to interest rates than do equity REITs. In the graph to the right, observe how the yield spread between the 10-year Treasury bond and the 3-month T-bill shows a cyclicality analogous to what we saw above for mortgage REITs.

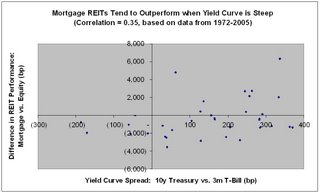

The cyclicality of mortgage REITs is due to the dependence of their underlying business on the yield curve. Managers of mortgage REITs typically leverage shareholder equity by borrowing additional funds short-term and investing into longer term debt instruments secured by real properties, similar to how banks and S&Ls run their deposit and lending businesses. Interest rate swaps and other financial derivatives may be used to manage yield curve risk, but mortgage REITs nevertheless show more sensitivity to interest rates than do equity REITs. In the graph to the right, observe how the yield spread between the 10-year Treasury bond and the 3-month T-bill shows a cyclicality analogous to what we saw above for mortgage REITs. By examining a scatter plot of yield curve spread (10-year Treasury yield minus 3-month T-bill yield) versus the difference in performance between equity and mortgage REITS (mortgage REIT return minus equity REIT return) for the years from 1972 to 2005, we can extract the relationship between the yield curve and mortgage REIT performance. When the yield curve is steep (long-term interest rates significantly higher than short-term interest rates), mortgage REITs have historically shown higher total returns. On the other hand, when the yield curve becomes flat or inverted (long-term interest rates comparable to or lower than short-term interest rates), mortgage REITs have typically underperformed equity REITs, as has been the case for the past two years. The basic mechanism behind this cyclical overperformance-underperformance behavior is that, particularly through using leverage, mortage REITs benefit from their ability to borrow at low interest rates and invest at higher long-term rates when the yield curve is steep, but have a much harder time finding sufficient yield pick-up from credit spreads alone in a flattish yield curve environment like the one we are now in (3-month T-bill at 4.5% vs. 10-year Treasury at 4.8%).

By examining a scatter plot of yield curve spread (10-year Treasury yield minus 3-month T-bill yield) versus the difference in performance between equity and mortgage REITS (mortgage REIT return minus equity REIT return) for the years from 1972 to 2005, we can extract the relationship between the yield curve and mortgage REIT performance. When the yield curve is steep (long-term interest rates significantly higher than short-term interest rates), mortgage REITs have historically shown higher total returns. On the other hand, when the yield curve becomes flat or inverted (long-term interest rates comparable to or lower than short-term interest rates), mortgage REITs have typically underperformed equity REITs, as has been the case for the past two years. The basic mechanism behind this cyclical overperformance-underperformance behavior is that, particularly through using leverage, mortage REITs benefit from their ability to borrow at low interest rates and invest at higher long-term rates when the yield curve is steep, but have a much harder time finding sufficient yield pick-up from credit spreads alone in a flattish yield curve environment like the one we are now in (3-month T-bill at 4.5% vs. 10-year Treasury at 4.8%).Whether mortgage REITs will recover from their current slump anytime soon depends on what happens to interest rates. The recent peak (6.5% in May 2000) and trough (1.0% in June 2003) of the targeted fed funds rate correspond approximately to the transition points demarcating periods of underperformance (1997-2000), outperformance (2001-2003) and a reversion to underperformance (2004 to present) by mortgage REITs over the past decade. If yesterday's FOMC decision under new fed chairman, Ben Bernanke, to raise the fed funds rate to 4.75% is the last in the current series of rate hikes initiated under Greenspan, and if the yield curve begins to steepen again, we should expect to see a turnaround in mortgage REITs over the upcoming year. However, given that the FOMC indicated in their press release that "some further policy firming may be needed," it seems more likely that short-term rates will continue to rise another 25 bp or so, prolonging the flat yield curve environment and continuing to put pressure on the profit margins of mortgage REITs. However, cycles being what they are, the day will certainly come when mortgage REITs once again rise from the dead, presenting an opportunity for investors who are able to time the market correctly.

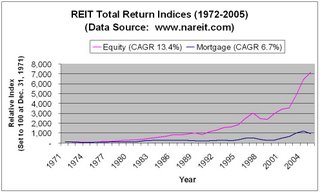

I close with a caveat based on the historical performance of mortgage and equity REITs. As NAREIT data from 1972 to 2005 indicate, equity REITs have returned 13.4% per annum, versus just 6.7% per annum for mortgage REITs over the past 34 years. The graph to the right shows how a $100 buy-and-hold position in the mortgage REIT index on December 31, 1971, would be worth about $1,000 today, while the same-size investment in the equity REIT index would have grown a whopping seven-fold more to $7,000!

I close with a caveat based on the historical performance of mortgage and equity REITs. As NAREIT data from 1972 to 2005 indicate, equity REITs have returned 13.4% per annum, versus just 6.7% per annum for mortgage REITs over the past 34 years. The graph to the right shows how a $100 buy-and-hold position in the mortgage REIT index on December 31, 1971, would be worth about $1,000 today, while the same-size investment in the equity REIT index would have grown a whopping seven-fold more to $7,000!Upshot: Mortgage REIT investing can be very rewarding if timed right; however, the more reliable long-term play may be to allocate a greater amount of investment capital to equity REITs and simply hang on for the ride.

25 Comments:

If we ignore that little morsel of spam so generously contributed by "Boston-Real-Estate-Watch"

When Helicopter Bernanke starts the money drop, then the mortgage REITs will suffer as mortgages get paid back with inflated dollars.

However many Mortgage REITs are undervalued and they are coughing out a lot of dividends. This flat yield curve cannot persist because of the arbitrage of borrowing long and then lending to risky short term debtors. This creates competition to lend to safer short term borrowers which then lowers short term interest rates.

Market Participant

Good morning,

A few months ago I started to write a blog about investing in private equity with reasonable amounts of money. As I have been interested in various investment opportunities, I love devoting time to my project.

To cut a long story short, I wanted to ask you if you'd be willing to exchange links with me? I believe my blog visitors are likely to be interested in your web site.

My blog's url is www.prosperousprivateequity.blogspot.com (or www.pprivateequity.com ).

I look forward to hearing from you soon.

Beste wishes,

Simon Rodriguez

cool blog, very informative. I got similar site like this, it's all about Australia private investment and financing provides medium and long-term finance through direct loans and loan guaranties to eligible Australian investment projects in developing areas and emerging markets. Would you mind if I ask you for a link exchange?

Regards...

Where ever I seem to go on the internet I come across a blog or a website regarding the situation of the economy. mortgage bonds seem to be on everybody's minds and so they should be! In a society where its nearly impossible to get a 100% mortgage, at least there is a little light at the end of the tunnel.

When refinancing a home loan, you'll rapidly understand that occasionally you will find all kinds of costs and markups which, in some cases, will wind up producing you spend as well a lot. Obtaining the very best house loan refinance feasible signifies avoiding as numerous unnecessary costs and expenses as feasible. Below are a few typical ideas which will let you turn out to be a lot more educated about home loan refinancing, and assist you to realize various costs and expenses.

Dealing with a variety of various home loan banks and lenders can frequently lead to numerous various choices and options. Also, you will see various costs or expenses with every loan kind, which are various from loan company to loan company. Had been you conscious that whenever you consult loan company or bank that the quoted rate of interest you obtain consists of a commission for that individual who got the financial loan together? There's, which is really typical. Nevertheless, you will find ways you can prevent paying that commission markup, and get a much better, "wholesale" rate of interest.

find cheap fixed rate mortgage deals

Great detailed informative post!your ability to share the information is a talent and very appreciated. Thanks for such an excellent post.

banks

We can no longer rely on the government to hand out an aged pension once we retire. We cannot take for granted that at the end of our working life we will be taken care of financially. Most of us have never sat down and even considered the ramifications of why the compulsory super was introduced and for many of us it is a matter of too little too late. Even for the young women in our society – who have a full working life ahead of them, they still cannot rest assured of a comfortable retirement.

Intraday Tips || Commodity Tips

When someone buys your house, you can get the money to pay it to the lender. Then you can focus on finding another home for your family.

equity release

You made some good points .I did a little research on the topic and found that most people agree with your blog. Thanks

Best Regards,

bullion tips

Equity REITs have benefited from the lengthy bull market in real estate, your information such a wonder full. thanks for sharing and cry on...nifty trading tips

Mortgage REITs deal in investment and ownership of property mortgages. These REITs loan money for mortgages to owners of real estate, or purchase existing mortgages or mortgage-backed securities. Their revenues are generated primarily by the interest that they earn on the mortgage loans.

Share Tips Free Trial

Great specific useful post!your capability to discuss the information is a capability and very valued. Thanks for such an outstanding publish....Mcx gold trading tips

Home loan REITs deal in financial commitment and possession of residence home mortgages. These REITs loan money for home mortgages to entrepreneurs of residence, or purchase current home mortgages or mortgage-backed investments. Their earnings are produced mainly by the interest that they generate on the loans....mcx today tips

Great particular useful post!your ability to talk about the details is a ability and very respected. Thanks for such an excellent publish.Gold Updates

Base metals are trading on the edge. Nearly all metals except mcx tips Copper 0.5-1 per cent of the exhibit. But copper is lower edge. On the London Metal Exchange have increasingly resorted to metals in the domestic market. Although you may know that the world is constantly increasing stock of copper commodity tips .And other metals over the demand picture is not clear yet.

MCX Copper is currently trading at Rs 396 with a gain of 0.4 per cent is. The aluminum 0.7 per cent, 1 per cent nickel, lead and zinc has gained 0.9 percent.

Red Chilli futures declined even faster. NCDEX chilli has come down to Rs 6,000 and is trading down nearly 2 percent. In view of this NCDEX chilli futures sell-off in June and July Special margin of 5 per cent is imposed.

As we all know that India have 2 major market and they both are fastest growing market in India and each traders want's to invest here but they prefer accuracy in tips and we are accurate tips for all traders....

Commodity Trading Tips |

Intraday Tips

Everyone knows Indian share market tips exchange is the place which is associated with both the large chance of gaining cash and also loss. This is the way that allows you to generate different earnings way and good return for your financial commitment if you have the capability to choose the right commodity tips provider or share tips provider. There is one thing that you must consider to find advantage in stock market industry is that spend your cash in right shares.If you are going to choose the right choice you have to do appropriate analysis but with the ever improving reputation of the internet it is also become always easy for you.

Either you are making money with Mcx-Live , gold tips or sureshot mcx tips, we will help you to gain more an more.

Nice blog and very informative. It provide us very important point for share market and commodity market. Also its most important for investors.

Thank you,

Intraday Jackpot Call

Great article, It's one of the best content in your site. I really impressed the post. Good work keep it up. Thanks for sharing the wonderful post.

gold tips advisor

Your blog post article is nice and also helpful to the trader............

Stock Market Tips

this is best blog post.

Crude Oil Trading Tips

Nice post about "Looking for a Bottom in Mortgage REITs"

thanks,

Jackpot Call in Crude Oil || MCX Sureshot Calls

waoo nice post about Looking for a Bottom in Mortgage REITs

Thanks,

Gold Tips Free Trial

awesome post regarding "Looking for a Bottom in Mortgage REITs"

Conference System on Hire in Delhi

DSLR Camera on Rent

Hello everyone, Are you looking for a professional trader, cryptocurrency/forex and binary manager who will help you trade and manager your account with good and massive amount of profit in return. you can contact Mr. Bernie for your investment plan, for he helped me earned $8,600 usd with little investment of $850 usd. Mr Bernie Doran you're the best trader I can recommend for anyone who wants to invest and trade with a genuine trader, he also helps in recovery of loss funds..you can contact him on his whatsapp: +1(424)285-0682 Email:(berniedoransignals@gmail.com)I advice you shouldn't hesitate He's great.

Post a Comment

<< Home