Where to Invest When the Housing Market Cools

Single-family homes have been a highly profitable place to invest for the past few years, with median U.S. house prices appreciating at a rapid double-digit clip not seen since the late 1970s. Like all bull markets, however, this trend will sooner or later reverse itself. Given indications that the housing market may be cooling as we move into 2006, it makes sense to consider alternative places to invest those extra dollars you have lying around.

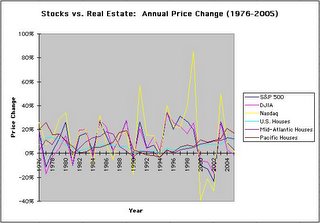

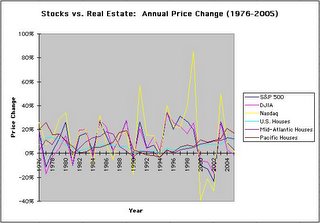

We all know that stock prices are more volatile than real estate prices. The graph to the right shows stock index and house price appreciation data for the past 30 years (source: Yahoo for stock indices, OFHEO for house prices). Stock prices tend to bounce around quite a bit, while real estate prices move in a slower, more predictable fashion.

We all know that stock prices are more volatile than real estate prices. The graph to the right shows stock index and house price appreciation data for the past 30 years (source: Yahoo for stock indices, OFHEO for house prices). Stock prices tend to bounce around quite a bit, while real estate prices move in a slower, more predictable fashion.

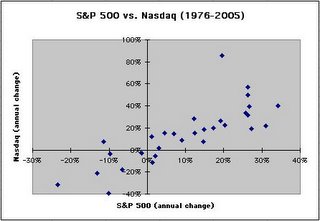

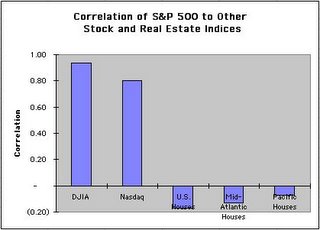

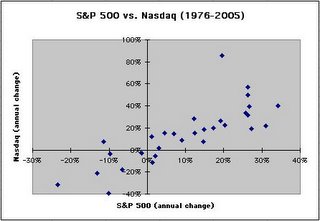

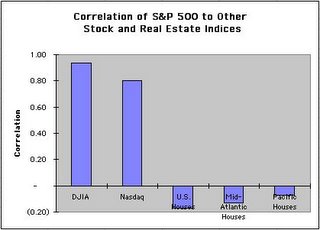

From an asset allocation perspective, what is of interest is the degree of correlation between stocks and real estate. As might be expected, the S&P 500 and Nasdaq stock indices have a high positive correlation of 0.80. When one goes up, so does the other. Similarly, the two stock indices tend to fall in tandem.

From an asset allocation perspective, what is of interest is the degree of correlation between stocks and real estate. As might be expected, the S&P 500 and Nasdaq stock indices have a high positive correlation of 0.80. When one goes up, so does the other. Similarly, the two stock indices tend to fall in tandem.

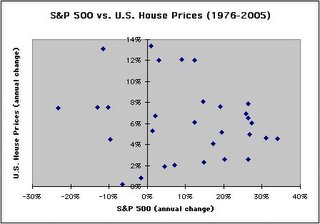

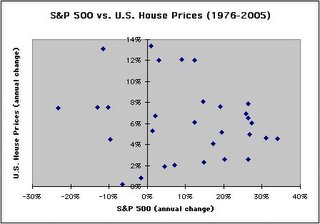

Real estate prices, on the other hand, have historically shown little relationship to stock prices, as indicated by the tremendous degree of "scatter" in the diagram to the right. The correlation of the S&P 500 stock index to U.S. median house prices is, in fact, slightly negative (-0.18), based on data from the past 30 years.

Real estate prices, on the other hand, have historically shown little relationship to stock prices, as indicated by the tremendous degree of "scatter" in the diagram to the right. The correlation of the S&P 500 stock index to U.S. median house prices is, in fact, slightly negative (-0.18), based on data from the past 30 years.

What's the implication? My interpretation is that, as the housing market cools, the stock market will likely become an increasingly attractive place to invest, consistent with the slight negative correlation between the two asset classes. 2005 was a year in which house prices (12% year-on-year increase in U.S. median house prices for period ending the third quarter of 2005) outperformed the stock market (3% return for the S&P 500). I expect that during 2006, it will be the stock market's turn to play a little catching up, as investors shift some of their speculative capital from rentals and second homes into stocks and mutual funds.

What's the implication? My interpretation is that, as the housing market cools, the stock market will likely become an increasingly attractive place to invest, consistent with the slight negative correlation between the two asset classes. 2005 was a year in which house prices (12% year-on-year increase in U.S. median house prices for period ending the third quarter of 2005) outperformed the stock market (3% return for the S&P 500). I expect that during 2006, it will be the stock market's turn to play a little catching up, as investors shift some of their speculative capital from rentals and second homes into stocks and mutual funds.

We all know that stock prices are more volatile than real estate prices. The graph to the right shows stock index and house price appreciation data for the past 30 years (source: Yahoo for stock indices, OFHEO for house prices). Stock prices tend to bounce around quite a bit, while real estate prices move in a slower, more predictable fashion.

We all know that stock prices are more volatile than real estate prices. The graph to the right shows stock index and house price appreciation data for the past 30 years (source: Yahoo for stock indices, OFHEO for house prices). Stock prices tend to bounce around quite a bit, while real estate prices move in a slower, more predictable fashion. From an asset allocation perspective, what is of interest is the degree of correlation between stocks and real estate. As might be expected, the S&P 500 and Nasdaq stock indices have a high positive correlation of 0.80. When one goes up, so does the other. Similarly, the two stock indices tend to fall in tandem.

From an asset allocation perspective, what is of interest is the degree of correlation between stocks and real estate. As might be expected, the S&P 500 and Nasdaq stock indices have a high positive correlation of 0.80. When one goes up, so does the other. Similarly, the two stock indices tend to fall in tandem. Real estate prices, on the other hand, have historically shown little relationship to stock prices, as indicated by the tremendous degree of "scatter" in the diagram to the right. The correlation of the S&P 500 stock index to U.S. median house prices is, in fact, slightly negative (-0.18), based on data from the past 30 years.

Real estate prices, on the other hand, have historically shown little relationship to stock prices, as indicated by the tremendous degree of "scatter" in the diagram to the right. The correlation of the S&P 500 stock index to U.S. median house prices is, in fact, slightly negative (-0.18), based on data from the past 30 years. What's the implication? My interpretation is that, as the housing market cools, the stock market will likely become an increasingly attractive place to invest, consistent with the slight negative correlation between the two asset classes. 2005 was a year in which house prices (12% year-on-year increase in U.S. median house prices for period ending the third quarter of 2005) outperformed the stock market (3% return for the S&P 500). I expect that during 2006, it will be the stock market's turn to play a little catching up, as investors shift some of their speculative capital from rentals and second homes into stocks and mutual funds.

What's the implication? My interpretation is that, as the housing market cools, the stock market will likely become an increasingly attractive place to invest, consistent with the slight negative correlation between the two asset classes. 2005 was a year in which house prices (12% year-on-year increase in U.S. median house prices for period ending the third quarter of 2005) outperformed the stock market (3% return for the S&P 500). I expect that during 2006, it will be the stock market's turn to play a little catching up, as investors shift some of their speculative capital from rentals and second homes into stocks and mutual funds.

2 Comments:

I believe that the best place to invest in real estate that is housing real estate is the southwest excluding the funny state on the left coast' that has thirty million people. All of the surrounding states will benifit from the mass amount of people leaving the state. I think the southwest looks very very promising here with one exception of course.

With the many blogs which I have encountered, I never expected to see a very beautiful post online..After reading this one, I felt so lucky to see its content..-)

Post a Comment

<< Home