Jones Soda (JSDA): A Premium Hip-Pop Brand in a Bottle

“Ya gotta make a living somehow; we chose the beverage world. Good old soda with a twist. No hidden meanings, no billion dollar ad campaigns. At Jones, we want you to buy a lot of soda and recycle the bottles. The labels are kinda like our minds—always changing. Run with the little guy . . . create some change. www.jonessoda.com” (Quote taken from a Jones soda bottle label)

“Ya gotta make a living somehow; we chose the beverage world. Good old soda with a twist. No hidden meanings, no billion dollar ad campaigns. At Jones, we want you to buy a lot of soda and recycle the bottles. The labels are kinda like our minds—always changing. Run with the little guy . . . create some change. www.jonessoda.com” (Quote taken from a Jones soda bottle label)A couple of summers ago when my son was gearing up to sell cans of soda around our neighborhood to earn a little pocket change, we stumbled across Hansen’s Natural soda at Costco and bought a case. As it turned out, the Cokes and Pepsis in my son’s inventory outsold the Hansens--which in retrospect was unfortunate, for if my son’s sales had only come in the other way around (i.e., with Hansen ahead of Coke and Pepsi), I might have caught this ten-bagger. As the historical stock charts now tell us, shares of Hansen (HANS) have soared from a lowly split-adjusted $10 per share that summer (July 2004) to their current price of $84, after touching an all-time high of $104 in mid-January.

A Seattle Times article over the weekend on Jones Soda (JSDA) got me thinking about soft drink companies again. Based on its $31 million trailing 12 months (ttm) of revenues, Jones Soda is tiny--with only about a tenth of Hansen’s $301 million in sales. Both companies are in the rapidly expanding alternative or New Age beverages sector of the soft drink market, selling new flavors of carbonated beverages and noncarbonated juices, energy drinks and teas. While Hansen has nearly quadrupled sales over the past two years by reaching out to a broader audience, Jones focuses on building a premium brand targeting Generation Xers and Yers in the 12 to 34 age group and has seen slower though still respectable double-digit annual revenue growth.

From an investment perspective, what’s important is the potential path of future earnings growth for Jones Soda.

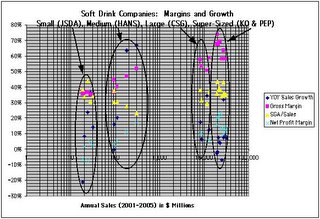

The chart to the right compares Jones Soda and Hansen to the largest soft drink makers based on sales: PepsiCo (PEP) (owning the brands Pepsi, Mountain Dew, Gatorade, Tropicana, Sierra Mist, etc.) with $31 billion revenue ttm; Coca-Cola (KO) (Coke, Sprite, Fanta, Canada Dry, Minutemaid, etc.) with $22 billion revenue; and Cadbury Schweppes (CSG) (Dr. Pepper, 7-Up, Snapple, Mott’s, Hawaiian Punch, etc.) with $12 billion revenue. Notice that gross margins and net profit margins tend to scale higher with increasing revenue. Tiny Jones has gross margins of around 35%, while giant Coca-Cola’s are an impressive 69%. Similarly, Jones’ net profit margins hover in the low single digits, compared to the lofty mid-twenties for Coca-Cola. Hansen’s net profit margin expanded from 3% to 20% during the past five years as revenues grew from $90 million to $300 million. The implication here is that efficiencies of scale could also drive Jones’ net profit margins much higher as revenue grows in the years ahead.

The chart to the right compares Jones Soda and Hansen to the largest soft drink makers based on sales: PepsiCo (PEP) (owning the brands Pepsi, Mountain Dew, Gatorade, Tropicana, Sierra Mist, etc.) with $31 billion revenue ttm; Coca-Cola (KO) (Coke, Sprite, Fanta, Canada Dry, Minutemaid, etc.) with $22 billion revenue; and Cadbury Schweppes (CSG) (Dr. Pepper, 7-Up, Snapple, Mott’s, Hawaiian Punch, etc.) with $12 billion revenue. Notice that gross margins and net profit margins tend to scale higher with increasing revenue. Tiny Jones has gross margins of around 35%, while giant Coca-Cola’s are an impressive 69%. Similarly, Jones’ net profit margins hover in the low single digits, compared to the lofty mid-twenties for Coca-Cola. Hansen’s net profit margin expanded from 3% to 20% during the past five years as revenues grew from $90 million to $300 million. The implication here is that efficiencies of scale could also drive Jones’ net profit margins much higher as revenue grows in the years ahead.In the consumer products area, brand acceptance determines survival and growth, especially for a small company like Jones (with a $135 million market cap) which aspires to expand beyond soft drinks to become a “lifestyle company.” Peter van Stolk, founder and CEO of Jones Soda, has mentioned that he can’t launch a successful brand tomorrow on a $100 million marketing budget, but if you “give me $10 million and five years to do it, I'll knock the ball out of the park. It's not about money, it's about time.”

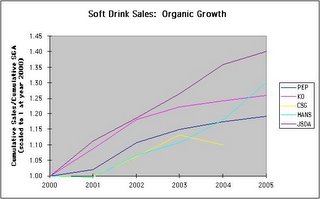

To see how effective Jones Soda’s promotional spending has been over recent years, we can take a look at the relative growth of revenues versus selling, general and administrative expense (SGA). Scaling the revenue-to-SGA ratio to one in the year 2000, I plot this ratio using cumulative revenue and SGA figures from the past five years, to gauge the “organic growth” of Jones versus Hansen and the larger companies. A more rapidly rising ratio means that promotional and related spending is successfully catalyzing faster revenue growth. Observe that Jones and Hansen have experienced the highest organic growth (steepest ascending lines in the chart). Jones’ growth has been more consistently rising, while Hansen’s has accelerated dramatically over the past couple of years.

To see how effective Jones Soda’s promotional spending has been over recent years, we can take a look at the relative growth of revenues versus selling, general and administrative expense (SGA). Scaling the revenue-to-SGA ratio to one in the year 2000, I plot this ratio using cumulative revenue and SGA figures from the past five years, to gauge the “organic growth” of Jones versus Hansen and the larger companies. A more rapidly rising ratio means that promotional and related spending is successfully catalyzing faster revenue growth. Observe that Jones and Hansen have experienced the highest organic growth (steepest ascending lines in the chart). Jones’ growth has been more consistently rising, while Hansen’s has accelerated dramatically over the past couple of years.Just how successful will Jones’ brand-building activity be in the future? Expanding marketing relationships through Starbucks, Target, Barnes & Noble, Panera Bread, Kroger and other retailers promise continued growth. Though difficult to measure, the unique way that Jones chooses to do business does, in my opinion, help to grow the brand. Allowing ordinary consumers to submit photos for Jones soda bottle labels (like the one at the upper left corner of this blog entry) fosters a lasting emotional connection to the product--this is the “co-value creation” the company mentions. Catchy soda flavors such as fufu berry, blue bubblegum and crushed melon give the consumer distinctive choices. Jones’ Thanksgiving flavors--turkey and gravy soda, wild herb stuffing soda, Brussels sprout soda, pumpkin pie soda--illustrate the company’s outrageous sense of humor tied to innovation. The company's adjunct myjonesmusic.com site supporting the independent music scene provides Jones Soda with a toehold in the media arena.

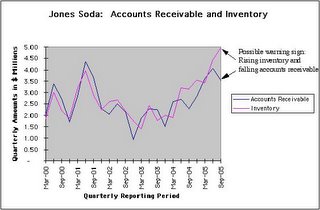

Despite all the positives, my review of the company’s most recent 10-Q financials raises a concern: During 2005Q3, accounts receivable fell to $3.5 million while inventory rose to an all-time high of $4.9 million, accompanied by a substantial increase in the ratio of finished goods to raw materials in inventory. A rising finished goods inventory going into the slower winter season could be an early warning sign, evidencing slower-than-expected sales during the high-season summer months. In fact, 2005Q3 revenue rose just 14% versus the same quarter in the prior year, the slowest revenue growth rate the company has seen in two years.

Despite all the positives, my review of the company’s most recent 10-Q financials raises a concern: During 2005Q3, accounts receivable fell to $3.5 million while inventory rose to an all-time high of $4.9 million, accompanied by a substantial increase in the ratio of finished goods to raw materials in inventory. A rising finished goods inventory going into the slower winter season could be an early warning sign, evidencing slower-than-expected sales during the high-season summer months. In fact, 2005Q3 revenue rose just 14% versus the same quarter in the prior year, the slowest revenue growth rate the company has seen in two years.The recent shift of Jones Soda shares from Nasdaq bulletin board to Nasdaq listed status should garner more attention from institutional investors and Wall Street analysts. Items to focus on when the company reports 2005Q4 earnings in the first part of March are:

Top-Line Revenue Growth: Average year-on-year revenue growth was 39% for the four reporting quarters in 2004, but growth slowed to 19%, 20% and 14% in the first three quarters of 2005. If year-on-year revenue growth falls below 20% (i.e., less than $7.7 million in revenue for 2005Q4), this could be a sign that brand-building is fizzling out.

Gross Margin: Over the past five years, gross margins have been stuck in a narrow range of 35% to 37%. During these same five years, Hansen’s gross margins improved from 40% to above 50%. Jones can generate future earnings acceleration by boosting gross margins, but this will probably take years to achieve.

Licensing Revenue: The two-year deal struck in 2004 to license Jones soda for sale in Target stores has generated a small but increasing revenue stream ($110k, $100k, $230k and $270k) over the past four reporting quarters. A significant increase in licensing revenue will contribute handily to bottom-line growth (each $230k gives an additional one cent in EPS).

Net Profit: The single analyst covering the company is projecting $0.02 in 2005Q4 earnings on $8.1 million of revenue (implying only a 9% seasonal falloff versus the $8.9 million reported for Q3, when in prior years the quarter-to-quarter revenue decline from Q3 to Q4 has typically been around 20% or more). With the anticipated boost from Target licensing revenue (which feeds into earnings but is excluded from top-line revenue in the company’s financials), I suspect that the bottom-line earnings number will be easier to reach than the analyst's top-line estimated revenue figure.

New CFO: The company’s long-standing CFO departed in November and has been replaced by an interim CFO. Look for confirmation that management transition is a smooth one.

Overall, I am excited by the long-term growth prospects of Jones Soda as a premium brand for Gen X and Y. Management appears to be on the right track towards building a truly original brand with lasting value. Trading at a price-to-sales ratio (ttm) of 4.3 (based on today's closing price of 6.29) with future growth prospects arguably better than Hansen's (which has a P/S ratio of 6), Jones' shares looks like an attractive investment. Pending 2005Q4 and subsequent revenue growth indicating that significantly more consumers are willing to pay the premium price ($1.70 a bottle) for a soda they really “don’t need” (in the CEO’s own words, one of the three company rules is “We don’t believe people need our soda”), I would offer the following prescription: Buy and hold a few shares for the next five years, waiting for the company to “knock the ball out of the park.”

5 Comments:

During the call, the CEO repeatedly mentioned the Jones Soda philosophy (emotional connection to customers, premium brand, etc.) but was less forthcominig than I would have liked on future plans. Giving management the benefit of doubt, their silence could be for competitive reasons; however, what if the company's longer-term expansion strategy is only half-baked? I like the strength of recent revenue and earnings growth, but I wonder how long the "in thing" mystique of their luxuriantly priced $1.75 bottle of soda can last.

Hi there,

Just read your post, i found it a very interesting read. Just thought i would let you know incase it is of any interest to you, a while back i got some bottle labels printed by a british labels company, they were really cheap on the labels looked great!

Really worthwhile data, much thanks for the post.

I would like to comment about jones soda. I bought cott corporation for 1 dollar its now trading at 7 dollars. I believe the stock could reach fifteen dollars over the next fews years The company cott corporation symbol COT is a private label beverage company they own RC cola along with other lines of beverages the company recently aquired another company in the same business. They are a two and a half billion dollar company they have a presence in wallmart stores. I believe that cott is still a much better value than jones soda.

Hello everyone, Are you looking for a professional trader, cryptocurrency/forex and binary manager who will help you trade and manager your account with good and massive amount of profit in return. you can contact Mr. Bernie for your investment plan, for he helped me earned $8,600 usd with little investment of $850 usd. Mr Bernie Doran you're the best trader I can recommend for anyone who wants to invest and trade with a genuine trader, he also helps in recovery of loss funds..you can contact him on his whatsapp: +1(424)285-0682 Email:(berniedoransignals@gmail.com)I advice you shouldn't hesitate He's great.

Post a Comment

<< Home