From Nano Cap to Mega Cap: Does Size Matter?

Nano cap, David, faces off with mega cap, Goliath.

(Photo credit)

You’ve heard of large, mid and small cap stocks, and probably also micro caps. But what about their gargantuan brethren, the mega caps, and at the other end of the size spectrum, the minuscule nano caps. According to Investopedia, the market cap ranges for publicly listed companies are: mega cap (above $200 billion market capitalization), large cap ($10 billion to $200 billion), mid cap ($2 billion to $10 billion), small cap ($300 million to $2 billion), micro cap ($50 million to $300 million), and nano cap (below $50 million).

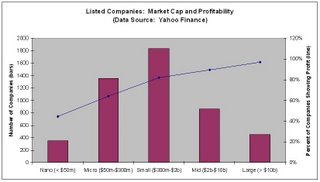

Does size matter? Mega caps like Exxon and GE are stable household names closely followed by Wall Street analysts. By contrast, nano caps typically trade very thinly, rarely make the news, and are avoided by most investors. To get a sense for how market capitalization matters, we can use a stock screener to compare the different size categories. For the approximately 5000 listed companies that come up in the Yahoo Finance stock screener, the data indicate that some 97% of mega and large caps are profitable, versus just 64% of the micro caps and an even lesser 44% of the nano caps. This direct relationship between size and profitabilty is as expected, since smaller caps include both younger companies that are not yet profitable and older companies with depressed stock prices from having experienced unfortunate rough patches in their growth paths.

Does size matter? Mega caps like Exxon and GE are stable household names closely followed by Wall Street analysts. By contrast, nano caps typically trade very thinly, rarely make the news, and are avoided by most investors. To get a sense for how market capitalization matters, we can use a stock screener to compare the different size categories. For the approximately 5000 listed companies that come up in the Yahoo Finance stock screener, the data indicate that some 97% of mega and large caps are profitable, versus just 64% of the micro caps and an even lesser 44% of the nano caps. This direct relationship between size and profitabilty is as expected, since smaller caps include both younger companies that are not yet profitable and older companies with depressed stock prices from having experienced unfortunate rough patches in their growth paths. Restricting the stock screening results to only those companies that have been profitable over the past 12 months, we can see how "typical" price ratios and profit margins relate to market cap. The graph to the right shows how P/E is steady across the market cap categories, with median P/E consistently in a fairly tight range from 19 to 22. In other words, P/E is quite independent of company size--which reinforces the tautology that “profit is profit,” whether it comes from an elephant (mega Goliath) or a flea (nano David).

Restricting the stock screening results to only those companies that have been profitable over the past 12 months, we can see how "typical" price ratios and profit margins relate to market cap. The graph to the right shows how P/E is steady across the market cap categories, with median P/E consistently in a fairly tight range from 19 to 22. In other words, P/E is quite independent of company size--which reinforces the tautology that “profit is profit,” whether it comes from an elephant (mega Goliath) or a flea (nano David).By looking at net profit margin (earnings divided by sales) and return on equity (ROE, or earnings divided by book equity value), we can get a sense for how companies evolve financially as they grow. Following its early stages when struggling to reach profitability, a successful growth company transitions from nano cap to micro cap as sales grow and profit margin expands into the mid to high single digits. Concurrently, ROE improves as the company is able to put capital to use ever more efficiently. The result is progressive evolution from the nano cap stage with a 4% profit margin and 7% ROE to the large (or even mega) cap stage with a 10% profit margin and 17% ROE.

From an investment point of view, an important element here is the multiplier effect. Suppose that a successful nano cap company is able to grow sales ten-fold. By what factor will its market cap expand? Taking the market cap of the nano company to be $40 million with a P/E of 20 (i.e., earnings of $2 million) and profit margin of 4% (i.e., sales of $50 million), ten-fold sales growth brings us to $500 million in annual sales. Efficiencies of scale boost profit margin from 4% to 8%, resulting in earnings of $40 million and a market cap of $800 million (at a P/E of 20). If sales grow another ten-fold to $5 billion, further efficiencies elevate the profit margin to 10%, resulting in earnings of $500 million and a market cap of $10 billion (again, at a P/E of 20). In this example, observe that sales have increased 100-fold, while market cap has risen 250 times, i.e., two and a half times faster. Instead of growing from nano to mid cap, the company has moved into the more prominent large cap category by exploiting efficiencies of scale and improving profit margins.

So, yes, at least in market capitalism as we know it today, size does matter.

10 Comments:

Good article on Nano Cap to Mega Cap!

I have to say those little Nano Caps have a shot and if you get a good solid Nano Cap, it may mean big money.

The Nano Caps are ultra risky, but it may be worth the risk, if the company has good financials. I keep an eye on them in the pink sheets.

I get into more detail about my views on penny stocks at PennyStocks and PinkSheets Blog

There are some good Nano Cap stocks out there, you just have to dig real deep! Keep up the good work on your blog! See you on the flipside.

Mr. Penny

This is very interesting information about Nano Cap stocks. There are certainly a lot of details like that to take into consideration. That’s a great point to bring up.

Diamond rings for ladies and gents, quality diamond engagement rings, secondhand and antique diamond engagement rings.

Diamond Rings

What a great post, I actually found it very thought provoking, you just never know sometimes when a golden nugget of information is going to land at your feet, thanks

isuzu parts

I think people should not hesitate in investing penny stocks particularly now when economy is recovering and there is an increase in the merger and acquisitions activity.

I like very much your way of presentation. I am so much interested to join your network. Thanks for sharing this post. Keep blogging.

Executive gifts

I have found that their are great values among megacap stocks. If you buy the right ones.

Valuable information and excellent design you got here!

The 3-4% average returns look meager, but note that since this is a market-neutral, self-funding portfolio, your prime broker (if you trade for a hedge fund or a proprietary trading firm) will allow you to leverage this return several times.small cap

Hello everyone, Are you looking for a professional trader, cryptocurrency/forex and binary manager who will help you trade and manager your account with good and massive amount of profit in return. you can contact Mr. Bernie for your investment plan, for he helped me earned $8,600 usd with little investment of $850 usd. Mr Bernie Doran you're the best trader I can recommend for anyone who wants to invest and trade with a genuine trader, he also helps in recovery of loss funds..you can contact him on his whatsapp: +1(424)285-0682 Email:(berniedoransignals@gmail.com)I advice you shouldn't hesitate He's great.

Post a Comment

<< Home