Chinese Internet Stocks: Barbelling for High Returns with NetEase at the Low-PE End

"Barbelling": A stock investment strategy involving concurrent long positions in both low-P/E and high-P/E stocks, premised on the assumption that the market tends to undervalue the growth potential of the "outliers" at both extremes of the price-earnings spectrum. (Photo credit)

"Barbelling": A stock investment strategy involving concurrent long positions in both low-P/E and high-P/E stocks, premised on the assumption that the market tends to undervalue the growth potential of the "outliers" at both extremes of the price-earnings spectrum. (Photo credit)With Sohu (SOHU), Baidu (BIDU) and Sina (SINA) having reported earnings during the past couple of weeks, we are now halfway through the 2006Q3 earnings calls for leading Chinese Internet companies in the portal, search and online gaming businesses. On deck for the coming week are NetEase (NTES) after the market close on Monday, November 6; and TOM Online (TOMO) before the open and Shanda (SNDA) after the close on Thursday, November 9; to be followed by The9 Limited (NCTY) on Wednesday, November 15.

So far for Q3, Sohu and Sina have reported solid earnings on strong growth in advertising revenues, exceeding analyst expectations and sending their share prices up 8% to 10% for the two-day periods centered about their respective earnings releases. Baidu's Q3 earnings and revenues exceeded expectations but revenue guidance was lighter than expected (attributed by management to a two-quarter transitional period needed for Baidu's advertisers to grow accustomed to recent changes introduced to optimize the company's ad monetization algorithm), resulting in highly volatile trading though little net price movement between the run-up to actual earnings release and Friday's close.

The Bigger Picture: Revenue and Earnings Fundamentals

It's easy to get carried away by all of the hype and emotion of short-term trading opportunities resulting from large price swings around earnings release dates. However, if we step back from the day-to-day volatility, we can obtain a clearer view of which stocks are most likely to perform best over a longer holding period.

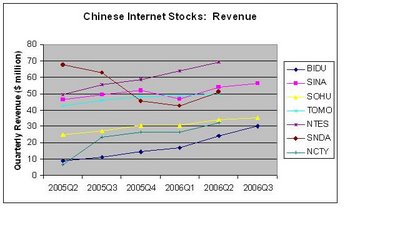

The revenue graph to the right reveals the varying "signatures" of the three types of Internet companies we are dealing with:

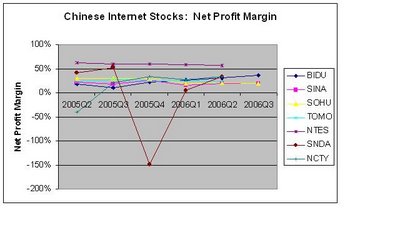

The revenue graph to the right reveals the varying "signatures" of the three types of Internet companies we are dealing with: Net profit margins also reveal differences in the character of the businesses:

Net profit margins also reveal differences in the character of the businesses:Overall, fundamentals indicate higher predictability of revenue streams and profitability in the search and portal businesses than in online gaming. However, since investors try to avoid uncertainty by gravitating towards industries with more top- and bottom-line financial regularity, good companies in volatile industries are often available at a discount.

Where's the Sweet Spot in the P/E Spectrum?

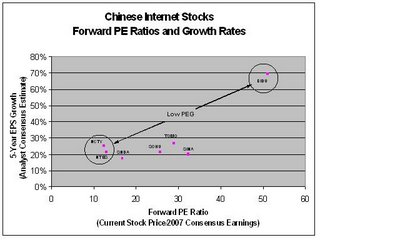

Using analyst consensus EPS figures for calendar year 2007 and 5-year earnings growth estimates (available on Yahoo Finance), we can plot forward P/E ratios against estimated earnings growth based on Friday's closing prices for the stocks we are considering. Viewing the data plotted in this way, we can see that the lowest PEG ratios (forward P/E divided by 5-year estimated growth) correspond to the Chinese Internet stocks with the lowest and highest P/E ratios:

Using analyst consensus EPS figures for calendar year 2007 and 5-year earnings growth estimates (available on Yahoo Finance), we can plot forward P/E ratios against estimated earnings growth based on Friday's closing prices for the stocks we are considering. Viewing the data plotted in this way, we can see that the lowest PEG ratios (forward P/E divided by 5-year estimated growth) correspond to the Chinese Internet stocks with the lowest and highest P/E ratios:In other words, assuming that Wall Street's consensus estimates are the "best reasonable guess" at future performance of each of the companies, the stocks with the lowest PEG ratios (i.e., best value) in today's market happen to sit at opposite ends of the P/E spectrum.

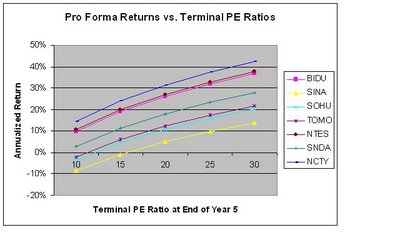

We can proceed to run a scenario analysis to see how an investment in each of the stocks would perform over the next five years, assuming that we buy at Friday's closing price, that earnings for 2007 meet analyst estimates, and that earnings grow thereafter in accordance with the 5-year consensus growth estimates. The graph to the right shows the annualized investment return resulting from a range of terminal P/E ratios at the end of the 5-year investment horizon. Notice that, for like P/E ratios, the stocks with the lowest PEG ratios--The9, NetEase and Baidu--offer the most attractive pro forma returns. If P/E ratios five years from now end up in a modest range around 20, the low PEG stocks will deliver 30% annual returns (vs. just 10% returns for their higher PEG brethren). If P/E ratios five years from now are higher, say, around 30 (which is very possible and perhaps even too conservative for Baidu), annual returns could approach the very attractive 40% level.

We can proceed to run a scenario analysis to see how an investment in each of the stocks would perform over the next five years, assuming that we buy at Friday's closing price, that earnings for 2007 meet analyst estimates, and that earnings grow thereafter in accordance with the 5-year consensus growth estimates. The graph to the right shows the annualized investment return resulting from a range of terminal P/E ratios at the end of the 5-year investment horizon. Notice that, for like P/E ratios, the stocks with the lowest PEG ratios--The9, NetEase and Baidu--offer the most attractive pro forma returns. If P/E ratios five years from now end up in a modest range around 20, the low PEG stocks will deliver 30% annual returns (vs. just 10% returns for their higher PEG brethren). If P/E ratios five years from now are higher, say, around 30 (which is very possible and perhaps even too conservative for Baidu), annual returns could approach the very attractive 40% level.Current market pricing of Chinese Internet stocks, then, suggests a "barbell" strategy involving taking long positions in both low-P/E (The9 and NetEase) and high-P/E (Baidu) stocks. Personally, I prefer NetEase over The9 because NetEase has a portal business to help cushion its fall if its gaming revenues soften, whereas The9 is dependent solely on gaming revenue. NetEase also has a longer operating history with more significant revenue and profitability than The9 (The9's annual revenue did not rise above the $5 million mark until 2005, propelled by the success of World of Warcraft). From a risk-return point of view, I like Baidu (see prior blog article) at the high-P/E end of the barbell, but for diversification I have recently taken a smaller position in NetEase at the low-P/E end.

Prospects for NetEase

Come Monday, we will see if NetEase beats analyst estimates ($0.28 EPS on $72 million revenue) to extend the winning streak for Chinse Internet stock 2006Q3 reporting led off by Sohu, Baidu and Sina. Portal advertising revenue will likely be strong, as it was for Sohu and Sina; however, even moderate weakness in gaming revenue beyond what's already priced into analyst estimates could very easily send NetEase shares into a tailspin. It is also possible that continuing lack of interest among Chinese gamers in NetEase's 2.5D game (Datang) and/or any delays or cautionary remarks regarding the company's upcoming and highly anticipated first-tier 3D game (Tianxia II, with open beta testing slated to begin by the end of Q4) could lead to a more muted outlook for 2007. Any new analyst downgrades on top of the already lengthy string of recent downgrades, any reduction of the EPS estimate for 2007 (now at $1.24, which is 10% above the $1.13 estimate for 2006), or a moderation of longer term growth estimates would negatively impact the share price. And, looking ahead, what if existing game revenue actually starts ramping down before new game revenue ramps up? Or, worse yet, what if Tianxia II turns out to be a complete flop?

But we can also paint a rosier picture: Suppose that NetEase is able to maintain revenue and earnings growth by continuing to publish expansion packs for Wesward Journey Online II and Fantasy Westward Journey until Tianxia II revenue firmly kicks in. The company's solid revenue track record provides evidence that its in-house game development team understands as well as, if not better than, any of its competitors how to tailor MMOGs for the Chinese market, and its success could very well continue, even with a game pipeline relying on only one or two primary titles. Then, aside from gaming, there's the possibility of revving up monetization of all of NetEase's portal traffic, which according to Alexa is higher than Sohu's (and Sohu manages to garner $35 million in quarterly revenue from brand advertising, wireless VAS and paid search, versus just $11 million for NetEase). NetEase also has the greatest number of free email users in China; hence, there ought to be an opportunity for monetization here as well.

So, maybe the consensus estimate of $1.24 EPS on $328 million in revenue (17% above estimated 2006 revenue) in 2007 is achievable. Maybe this time Wall Street analysts have their numbers right. Maybe NetEase will at least meet or perhaps even beat estimates for 2006Q3 with its earnings release on Monday. Maybe the company's $100 million share repurchase program (announced at end of August 2006, and ongoing for up to six months) will help its depressed shares join the party (versus one year ago, share performance has been: Sohu, up 50%; Sina, up 13%; NetEase, down 23%). And maybe 35-year old founder and CEO, William Ding, will muster up the resolve (in his own words: "Smart guys seize opportunities. . .") to grow NetEase's business and boost himself back into the #1 spot in China's wealth ranking, a position he briefly held three years ago when NetEase shares reached a prior peak (trading around $17 in October 2003, roughly where the stock trades today). Since 2003, other more fortunate Chinese (see the new Forbes list) have seen their wealth rise--while Mr. Ding's net worth has stalled, easing him down (pun not necessarily intended) to the #12 position among China's richest today.

Lots of maybes here. Maybe too many? Hopefully not, though time will tell. Let's see what Mr. Ding and company deliver after the closing bell on Monday.

2 Comments:

Love the blog! What do you think of NTES long calls in 09

I have a web site where I give advise on penny stocks and stocks under five dollars. I have many years of experience with these type of stocks. If theirs anyone interested in these type of stocks you can check out my web site by just clicking Penny stocks. I would like to comment about the future of the stock market theirs always bargains in the stock market you just have to be willing to take the time to find them. Speaking of stocks under one dollar that worked out for me. I recently sold my shares in vonage holdings corporation for 5 dollars. I bought the shares in 2009 for 37 cents. This was a rare exception to the general rule most of the stocks trading under 1 dollar are not good investments. The way that you find low priced stocks that are worthy investments is to have as much knowledge and experience as possible about these type of securities. Only than can you profit tremendously from these stocks.

Post a Comment

<< Home