If You Missed Google's Run-Up, "Do Buy" Baidu

Warning: The following message could be good for your financial health, but (as usual) I offer no performance guarantees.

Pause for a moment to reflect upon what you were thinking a couple of years ago in August 2004 when Google (GOOG) went public. If you're like most people (myself included, though I have an excuse--my inaction is consistent with my stated policy of not buying IPOs), you didn't partake of the opportunity to grab a few Google shares. You sat uncomfortably sidelined when Google went public, watching with as much profit-envy as intrigue as the $85 IPO ran up to $100 on the first trading day and vaulted ahead to $200 by the end of December 2004. You rationally waited for the "inevitable" pullback to a more reasonable price level, but this pullback never materialized. Instead of buying into the fray, you passively watched Google's shares surge ahead to $300 by mid-2005 and beyond the $400 mark by year-end. Now, after a solid 2006Q3 earnings report last week, the shares sit perched at $460, close to their all-time high of $475. Following the earnings report, analysts have raised their price targets to as high as $600, reaffirming earlier optimism. At a market cap of $140 billion, a trailing P/E (2005Q4 to 2006Q3) of 58, and a forward P/E of 35 (based on analyst consensus 2007 EPS estimate of $13.07), Google is hardly cheap.

Pause for a moment to reflect upon what you were thinking a couple of years ago in August 2004 when Google (GOOG) went public. If you're like most people (myself included, though I have an excuse--my inaction is consistent with my stated policy of not buying IPOs), you didn't partake of the opportunity to grab a few Google shares. You sat uncomfortably sidelined when Google went public, watching with as much profit-envy as intrigue as the $85 IPO ran up to $100 on the first trading day and vaulted ahead to $200 by the end of December 2004. You rationally waited for the "inevitable" pullback to a more reasonable price level, but this pullback never materialized. Instead of buying into the fray, you passively watched Google's shares surge ahead to $300 by mid-2005 and beyond the $400 mark by year-end. Now, after a solid 2006Q3 earnings report last week, the shares sit perched at $460, close to their all-time high of $475. Following the earnings report, analysts have raised their price targets to as high as $600, reaffirming earlier optimism. At a market cap of $140 billion, a trailing P/E (2005Q4 to 2006Q3) of 58, and a forward P/E of 35 (based on analyst consensus 2007 EPS estimate of $13.07), Google is hardly cheap.

There's also the story of Baidu (BIDU), the dominant Chinese search provider whose stock Google once owned (2.6% of Baidu's shares) but later sold. In contrast to Google's well-publicized success story (and presumably to Google's chagrin), during the past year Baidu has succeeding in further wrestling search market share away from Google in China (up to Baidu 62% vs. Google 25% in August 2006, from Baidu 52% vs. Google 33% in August 2005). With its IPO priced at just $27 in August 2005, Baidu's shares spiked to $151 before closing at $123 on the first trading day. In highly volatile trading, the shares have sagged as low as $45 in February of this year but have since recovered to close at $87 last week. Currently Baidu has a market cap of $2.9 billion, a trailing P/E of 126 (for 2005Q4 to 2006Q3, using analyst consensus EPS estimate of $0.26 for 2006Q3 earnings due out October 31), and a forward P/E of 51 (based on analyst consensus 2007 EPS estimate of $1.69).

There's also the story of Baidu (BIDU), the dominant Chinese search provider whose stock Google once owned (2.6% of Baidu's shares) but later sold. In contrast to Google's well-publicized success story (and presumably to Google's chagrin), during the past year Baidu has succeeding in further wrestling search market share away from Google in China (up to Baidu 62% vs. Google 25% in August 2006, from Baidu 52% vs. Google 33% in August 2005). With its IPO priced at just $27 in August 2005, Baidu's shares spiked to $151 before closing at $123 on the first trading day. In highly volatile trading, the shares have sagged as low as $45 in February of this year but have since recovered to close at $87 last week. Currently Baidu has a market cap of $2.9 billion, a trailing P/E of 126 (for 2005Q4 to 2006Q3, using analyst consensus EPS estimate of $0.26 for 2006Q3 earnings due out October 31), and a forward P/E of 51 (based on analyst consensus 2007 EPS estimate of $1.69).

Judging from its P/E alone, Baidu is clearly "priced for even higher perfection" than Google. But when we bring longer-term growth into the equation, a different picture emerges. Based on analysts' estimated 5-year earnings growth of 31% for Google and 63% for Baidu, and working with the 2007 forward P/E figures above, we have PEG ratios of 1.1 for Google and a lower 0.8 for Baidu. Upshot: Judging from PEG, Baidu is actually somewhat cheaper than Google.

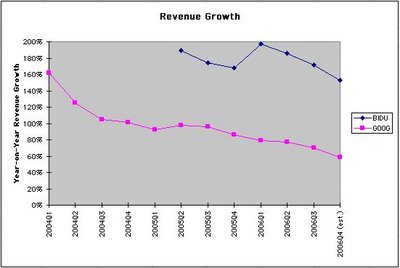

A few historical financials can help us make an intelligent guess about where Baidu's share price may be heading and just how rapidly. As the graph to the right shows, Google's year-on-year revenue growth has slowed from around 160% in 2004Q1 to the still very respectable 70% reported for 2006Q3. Baidu's revenue growth rides on a substantially higher tier than Google's, having floated in the 170% to 200% range for the past five quarters. Two inferences into Baidu's financial future seem reasonable: a) Conservative: Baidu is about two to three years "younger" than Google, and its growth rate should fall to around 70% sometime around 2008 or 2009; or b) More Aggressive: Baidu's growth rate will remain in the low triple digits (100% to 150%) for at least the next couple of years, driven by both macroeconomic (China's rapid economic growth, massive rural-to-urban migration, stimulus from the upcoming Beijing Summer Olympics) and industry-specific (Baidu's #1 traffic ranking in China, dominant search market share, related product launches) factors.

A few historical financials can help us make an intelligent guess about where Baidu's share price may be heading and just how rapidly. As the graph to the right shows, Google's year-on-year revenue growth has slowed from around 160% in 2004Q1 to the still very respectable 70% reported for 2006Q3. Baidu's revenue growth rides on a substantially higher tier than Google's, having floated in the 170% to 200% range for the past five quarters. Two inferences into Baidu's financial future seem reasonable: a) Conservative: Baidu is about two to three years "younger" than Google, and its growth rate should fall to around 70% sometime around 2008 or 2009; or b) More Aggressive: Baidu's growth rate will remain in the low triple digits (100% to 150%) for at least the next couple of years, driven by both macroeconomic (China's rapid economic growth, massive rural-to-urban migration, stimulus from the upcoming Beijing Summer Olympics) and industry-specific (Baidu's #1 traffic ranking in China, dominant search market share, related product launches) factors.

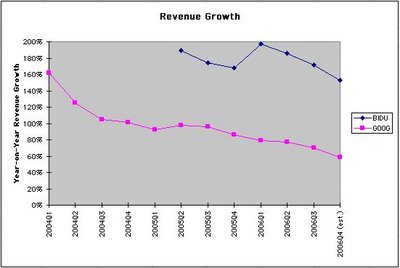

Both Google and Baidu currently sport healthy net profit margins of around 25% to 30% (see graph). To get a sense of its share growth potential, let's assume that Baidu's profit margins stay where they are, maintained by sufficient R&D spending, with revenue growth being the primary driver of share price over the next few years. Here's how our two scenarios play out:

Both Google and Baidu currently sport healthy net profit margins of around 25% to 30% (see graph). To get a sense of its share growth potential, let's assume that Baidu's profit margins stay where they are, maintained by sufficient R&D spending, with revenue growth being the primary driver of share price over the next few years. Here's how our two scenarios play out:

a) Conservative: Baidu's revenue growth gradually slows from 170% to 70% over the next two years. Annualized revenue advances four-fold from $120 million (based on analysts' estimate of $30 million for 2006Q3) to around $500 million by 2008Q3 (the quarter of the Beijing Summer Olympics). At a 2008Q3 price-to-sales multiple of 13 (equivalent to Google's P/S ratio today, $140 billion/$11 billion), this puts Baidu at a two-year forward valuation of $6.5 billion.

b) More Aggressive: If the market opportunity in China allows Baidu's revenue growth to remain in the 100% to 150% range for at least the next two years, we can expect up to a six-fold increase in annualized revenue to around $700 million by 2008Q3 (still a paltry 6% of Google's current $11 billion annualized revenue stream!). At the same P/S multiple of 13 used above, Baidu's two-year forward valuation would reach $9 billion. However, if Baidu's revenue growth is still hovering around 100% two years from now, the P/S multiple will likely sit higher, somewhere between Google's current 13 (at 70% revenue growth) and Baidu's 24 ($2.9 billion/$120 million, at 170% revenue growth). A mid-range P/S multiple of 18 would indicate a two-year forward valuation of $13 billion.

This quick analysis indicates how Baidu's valuation has the potential to rise from $2.9 billion today to the $6.5 billion to $13 billion range in the next couple of years. Allowing for moderate dilution from stock option exercise, we're looking at the real possibility of a very respectable two- to four-bagger performance by the end of 2008.

Of course, there's potential downside, too--from regulatory risk, music copyright litigation, click fraud accusations, competitive pressures, changing consumer habits, economic recession, etc. However, I think the potential upside is juicy enough to justify buying at least a toehold into the Baidu opportunity (Disclosure: I've recently taken a long position). The shares are now "seasoned" following their August 2005 IPO and the company's five-quarter reporting history gives future projections a sounder footing. At last Friday's close of $87, Baidu's shares are more expensive than they were at their February price-bottom of $45; yet they are also a lot cheaper than they were at their $154 intra-day price peak the day after the IPO.

Given Baidu's growing Chinese search market share and noting just how negative Wall Street analysts presently are on Baidu (current ratings: Google 1.9 (buy) vs. Baidu 3.1 (neutral)), I expect Baidu's earnings numbers easily to surpass analysts' expectations (EPS of $0.26 on $30 million revenue) when the company reports 2006Q3 results on October 31. During the conference call, it will also be interesting to listen for commentary on how Baidu is progressing on its new initiatives: the MTV video distribution alliance announced last week (can popularity of YouTube-style apps for China be far away?), Baidu's collaboration with HP on preloaded search, Baidu Space (a blogging site) launched in July, and Baidupedia (like Wikipedia) launched earlier this year. All of these initiatives complement Baidu's core search and established, "sticky," community-oriented services such as popular Baidu Post Bar (a message board hang-out similar in some ways to Technorati) and Baidu Knows (similar to and launched before Yahoo Answers).

If you overslept the morning the "Google express" left Silicon Valley Station two years ago, don't fret, for it's probably not too late to jump aboard the "Baidu express" while you still can. As I mentioned in a traffic ranking review early last year (incidentally, Baidu has advanced from #6 at that time to #4 today in Alexa's Global Top 500 ranking, now behind only Yahoo, MSN and Google), search remains the rising star of the Internet. In my opinion, there is no company better positioned today than Baidu to harvest the seemingly boundless growth potential the Chinese market offers. (Here's a recent article for further background reading on Baidu.)

By listening carefully, you should be able to hear Baidu's "little engine that could" chugging along on the fast track with its wheels humming "Do buy Baidu, do buy Baidu, do buy Baidu. . . ." All aboard!

Pause for a moment to reflect upon what you were thinking a couple of years ago in August 2004 when Google (GOOG) went public. If you're like most people (myself included, though I have an excuse--my inaction is consistent with my stated policy of not buying IPOs), you didn't partake of the opportunity to grab a few Google shares. You sat uncomfortably sidelined when Google went public, watching with as much profit-envy as intrigue as the $85 IPO ran up to $100 on the first trading day and vaulted ahead to $200 by the end of December 2004. You rationally waited for the "inevitable" pullback to a more reasonable price level, but this pullback never materialized. Instead of buying into the fray, you passively watched Google's shares surge ahead to $300 by mid-2005 and beyond the $400 mark by year-end. Now, after a solid 2006Q3 earnings report last week, the shares sit perched at $460, close to their all-time high of $475. Following the earnings report, analysts have raised their price targets to as high as $600, reaffirming earlier optimism. At a market cap of $140 billion, a trailing P/E (2005Q4 to 2006Q3) of 58, and a forward P/E of 35 (based on analyst consensus 2007 EPS estimate of $13.07), Google is hardly cheap.

Pause for a moment to reflect upon what you were thinking a couple of years ago in August 2004 when Google (GOOG) went public. If you're like most people (myself included, though I have an excuse--my inaction is consistent with my stated policy of not buying IPOs), you didn't partake of the opportunity to grab a few Google shares. You sat uncomfortably sidelined when Google went public, watching with as much profit-envy as intrigue as the $85 IPO ran up to $100 on the first trading day and vaulted ahead to $200 by the end of December 2004. You rationally waited for the "inevitable" pullback to a more reasonable price level, but this pullback never materialized. Instead of buying into the fray, you passively watched Google's shares surge ahead to $300 by mid-2005 and beyond the $400 mark by year-end. Now, after a solid 2006Q3 earnings report last week, the shares sit perched at $460, close to their all-time high of $475. Following the earnings report, analysts have raised their price targets to as high as $600, reaffirming earlier optimism. At a market cap of $140 billion, a trailing P/E (2005Q4 to 2006Q3) of 58, and a forward P/E of 35 (based on analyst consensus 2007 EPS estimate of $13.07), Google is hardly cheap. There's also the story of Baidu (BIDU), the dominant Chinese search provider whose stock Google once owned (2.6% of Baidu's shares) but later sold. In contrast to Google's well-publicized success story (and presumably to Google's chagrin), during the past year Baidu has succeeding in further wrestling search market share away from Google in China (up to Baidu 62% vs. Google 25% in August 2006, from Baidu 52% vs. Google 33% in August 2005). With its IPO priced at just $27 in August 2005, Baidu's shares spiked to $151 before closing at $123 on the first trading day. In highly volatile trading, the shares have sagged as low as $45 in February of this year but have since recovered to close at $87 last week. Currently Baidu has a market cap of $2.9 billion, a trailing P/E of 126 (for 2005Q4 to 2006Q3, using analyst consensus EPS estimate of $0.26 for 2006Q3 earnings due out October 31), and a forward P/E of 51 (based on analyst consensus 2007 EPS estimate of $1.69).

There's also the story of Baidu (BIDU), the dominant Chinese search provider whose stock Google once owned (2.6% of Baidu's shares) but later sold. In contrast to Google's well-publicized success story (and presumably to Google's chagrin), during the past year Baidu has succeeding in further wrestling search market share away from Google in China (up to Baidu 62% vs. Google 25% in August 2006, from Baidu 52% vs. Google 33% in August 2005). With its IPO priced at just $27 in August 2005, Baidu's shares spiked to $151 before closing at $123 on the first trading day. In highly volatile trading, the shares have sagged as low as $45 in February of this year but have since recovered to close at $87 last week. Currently Baidu has a market cap of $2.9 billion, a trailing P/E of 126 (for 2005Q4 to 2006Q3, using analyst consensus EPS estimate of $0.26 for 2006Q3 earnings due out October 31), and a forward P/E of 51 (based on analyst consensus 2007 EPS estimate of $1.69).Judging from its P/E alone, Baidu is clearly "priced for even higher perfection" than Google. But when we bring longer-term growth into the equation, a different picture emerges. Based on analysts' estimated 5-year earnings growth of 31% for Google and 63% for Baidu, and working with the 2007 forward P/E figures above, we have PEG ratios of 1.1 for Google and a lower 0.8 for Baidu. Upshot: Judging from PEG, Baidu is actually somewhat cheaper than Google.

A few historical financials can help us make an intelligent guess about where Baidu's share price may be heading and just how rapidly. As the graph to the right shows, Google's year-on-year revenue growth has slowed from around 160% in 2004Q1 to the still very respectable 70% reported for 2006Q3. Baidu's revenue growth rides on a substantially higher tier than Google's, having floated in the 170% to 200% range for the past five quarters. Two inferences into Baidu's financial future seem reasonable: a) Conservative: Baidu is about two to three years "younger" than Google, and its growth rate should fall to around 70% sometime around 2008 or 2009; or b) More Aggressive: Baidu's growth rate will remain in the low triple digits (100% to 150%) for at least the next couple of years, driven by both macroeconomic (China's rapid economic growth, massive rural-to-urban migration, stimulus from the upcoming Beijing Summer Olympics) and industry-specific (Baidu's #1 traffic ranking in China, dominant search market share, related product launches) factors.

A few historical financials can help us make an intelligent guess about where Baidu's share price may be heading and just how rapidly. As the graph to the right shows, Google's year-on-year revenue growth has slowed from around 160% in 2004Q1 to the still very respectable 70% reported for 2006Q3. Baidu's revenue growth rides on a substantially higher tier than Google's, having floated in the 170% to 200% range for the past five quarters. Two inferences into Baidu's financial future seem reasonable: a) Conservative: Baidu is about two to three years "younger" than Google, and its growth rate should fall to around 70% sometime around 2008 or 2009; or b) More Aggressive: Baidu's growth rate will remain in the low triple digits (100% to 150%) for at least the next couple of years, driven by both macroeconomic (China's rapid economic growth, massive rural-to-urban migration, stimulus from the upcoming Beijing Summer Olympics) and industry-specific (Baidu's #1 traffic ranking in China, dominant search market share, related product launches) factors. Both Google and Baidu currently sport healthy net profit margins of around 25% to 30% (see graph). To get a sense of its share growth potential, let's assume that Baidu's profit margins stay where they are, maintained by sufficient R&D spending, with revenue growth being the primary driver of share price over the next few years. Here's how our two scenarios play out:

Both Google and Baidu currently sport healthy net profit margins of around 25% to 30% (see graph). To get a sense of its share growth potential, let's assume that Baidu's profit margins stay where they are, maintained by sufficient R&D spending, with revenue growth being the primary driver of share price over the next few years. Here's how our two scenarios play out:a) Conservative: Baidu's revenue growth gradually slows from 170% to 70% over the next two years. Annualized revenue advances four-fold from $120 million (based on analysts' estimate of $30 million for 2006Q3) to around $500 million by 2008Q3 (the quarter of the Beijing Summer Olympics). At a 2008Q3 price-to-sales multiple of 13 (equivalent to Google's P/S ratio today, $140 billion/$11 billion), this puts Baidu at a two-year forward valuation of $6.5 billion.

b) More Aggressive: If the market opportunity in China allows Baidu's revenue growth to remain in the 100% to 150% range for at least the next two years, we can expect up to a six-fold increase in annualized revenue to around $700 million by 2008Q3 (still a paltry 6% of Google's current $11 billion annualized revenue stream!). At the same P/S multiple of 13 used above, Baidu's two-year forward valuation would reach $9 billion. However, if Baidu's revenue growth is still hovering around 100% two years from now, the P/S multiple will likely sit higher, somewhere between Google's current 13 (at 70% revenue growth) and Baidu's 24 ($2.9 billion/$120 million, at 170% revenue growth). A mid-range P/S multiple of 18 would indicate a two-year forward valuation of $13 billion.

This quick analysis indicates how Baidu's valuation has the potential to rise from $2.9 billion today to the $6.5 billion to $13 billion range in the next couple of years. Allowing for moderate dilution from stock option exercise, we're looking at the real possibility of a very respectable two- to four-bagger performance by the end of 2008.

Of course, there's potential downside, too--from regulatory risk, music copyright litigation, click fraud accusations, competitive pressures, changing consumer habits, economic recession, etc. However, I think the potential upside is juicy enough to justify buying at least a toehold into the Baidu opportunity (Disclosure: I've recently taken a long position). The shares are now "seasoned" following their August 2005 IPO and the company's five-quarter reporting history gives future projections a sounder footing. At last Friday's close of $87, Baidu's shares are more expensive than they were at their February price-bottom of $45; yet they are also a lot cheaper than they were at their $154 intra-day price peak the day after the IPO.

Given Baidu's growing Chinese search market share and noting just how negative Wall Street analysts presently are on Baidu (current ratings: Google 1.9 (buy) vs. Baidu 3.1 (neutral)), I expect Baidu's earnings numbers easily to surpass analysts' expectations (EPS of $0.26 on $30 million revenue) when the company reports 2006Q3 results on October 31. During the conference call, it will also be interesting to listen for commentary on how Baidu is progressing on its new initiatives: the MTV video distribution alliance announced last week (can popularity of YouTube-style apps for China be far away?), Baidu's collaboration with HP on preloaded search, Baidu Space (a blogging site) launched in July, and Baidupedia (like Wikipedia) launched earlier this year. All of these initiatives complement Baidu's core search and established, "sticky," community-oriented services such as popular Baidu Post Bar (a message board hang-out similar in some ways to Technorati) and Baidu Knows (similar to and launched before Yahoo Answers).

If you overslept the morning the "Google express" left Silicon Valley Station two years ago, don't fret, for it's probably not too late to jump aboard the "Baidu express" while you still can. As I mentioned in a traffic ranking review early last year (incidentally, Baidu has advanced from #6 at that time to #4 today in Alexa's Global Top 500 ranking, now behind only Yahoo, MSN and Google), search remains the rising star of the Internet. In my opinion, there is no company better positioned today than Baidu to harvest the seemingly boundless growth potential the Chinese market offers. (Here's a recent article for further background reading on Baidu.)

By listening carefully, you should be able to hear Baidu's "little engine that could" chugging along on the fast track with its wheels humming "Do buy Baidu, do buy Baidu, do buy Baidu. . . ." All aboard!

39 Comments:

We are provider of Indian Stock Market Trading Tips, Share Tips, Stock Calls

Also see our Services at INDIAN SHARE BAZAAR NIFTY TIPS FREE TRIAL TIPS

We Provide The Best Sure Shot Nifty Future Tips For 100% Intraday Profits only.You will get Smallest Stoploss, Nifty Future Tips on SMS and Messenger

First Time in the History of the INDIAN STOCK MARKETS NiftyFutureKing introduces the INDIAN STOCK SCREENER absolutely free for the benefit of INDIAN TRADERS/INVESTORS both for making decisions regarding Intraday Trading Tips/NSE Stock Tips

We offer intraday tips expert share tips for Intraday tips, intraday trading tips, share tips intraday, share market tips Stock recommendations, STOCK TIPS, Indian market stock tips, Stock market, Stock Market India, Indian Stock Market

stock tips

Hello.. Firstly I would like to send greetings to all readers. After this, I recognize the content so interesting about this article. For me personally I liked all the information. I would like to know of cases like this more often. In my personal experience I might mention a book called Green Parks Costa Rica in this book that I mentioned have very interesting topics, and also you have much to do with the main theme of this article.

very good article sir.

I have been reading your entries all through my morning break, and I must admit the whole article has been very enlightening and rather well written. I assumed I would assist you to recognize that for some reason this weblog does not view well in Internet Explorer 8. I wish Microsoft might stop converting their software. I’ve a query for you. Could you thoughts replacing weblog roll hyperlinks? That would be in point of fact neat!

technical analysis training

learn technical analysis

I have been reading your entries all through my morning break, and I must admit the whole article has been very enlightening and rather well written. I assumed I would assist you to recognize that for some reason this weblog does not view well in Internet Explorer 8. I wish Microsoft might stop converting their software. I’ve a query for you. Could you thoughts replacing weblog roll hyperlinks? That would be in point of fact neat!

option tips

There are some interesting points in time in this clause but I don’t know if I see all of them middle to eye . There is some validity but I will take hold opinion until I look into it further. Good article , thanks and we want more! Added to FeedBurner likewise.

learn technical analysis

we provide the best stock tips in india with out any monthly subscriptions.

stock tips

This cannot succeed in reality, that is exactly what I suppose.

I just couldnt leave your website before telling you that we really enjoyed the useful information you offer to your visitors… Will be back soon to check up on new posts

seo services in delhi

Thanks For sharing with Us.i am searching from many places, i get many more but not working for me then i try this one and work for me….

Mcx Tips, Nifty tips

Stock market is the best to make huge profit, i agree with all of you views. Share Tips India

We http://100mcxtips.com provide "Best Commodity MCX and Equity Tips" which are a vital part of both Intraday and cash & Future-Option traders success. The right plan for "100 sure intraday MCX Tips", not only ensures that you have enough money earning opportunities and success for your online Trading, 100 MCX Tips can also improve the chances of earning money and make it more profitable and sparkle your online Trading carrier . Since there are hundreds of companies who will give you " Best MCX Commodity tips"

http://100mcxtips.com

Thank you for this blog. Thats all I can say. You most definitely have made this blog into something thats eye opening and important. You clearly know so much about the subject, youve covered so many bases. Great stuff from this part of the internet. Again, thank you for this blog. Fundamental analysis training

Equity analysis

Hii, i am from "epic research" finanasial companay which are provide all the information related to stoks.which are give tips

money earning opportunities and success for your online Trading,for MCX Tips,commodity tips and all stoks.

Really nice information.keep blogging. commodity Tips

Get sureshot ncdex tips,commodity trading tips and base metal tips.

People say gold is cash money, we say trading in gold is money is, because truly it is. There are gold investors all over the world who are making a remarkable money, it's a well kept secret. But according to commoditytradingcall will help you to become effective and smart trader in gold trading tips, we will help you to learn our program of dealing and help you reach your financial targets. No more having to work for somebody else, no more having to battle traffic or work with other individuals you don't get along with. Welcome to the magic of learning how to business or trade in gold using our unique and effective trading plan.

Either you are making money with Intraday Trading Tips, Intraday Mcx Tips, gold tips or sureshot mcx tips, we will help you to gain more an more.

There are lots of people are Investing in share market and commodity market. This market is the one of the most famous business formula to expanding our money in a short time also the style of trading has been changed. Now the Traders are taking suggestion from a share market adviser who have good knowledge about commodity and share market. If we want to get positive calls or tips so we should always take advice from a knowledgeable advisory company. who provide tips like Mcx Jackpot Call, Commodity Jackpot Call, and more. It will beneficial for us and that time we will not be chance to loss.

Thank you,

Mcx Gold Jackpot Call

ShareShoppe is an enterprise by Swastika Investmart Limited, a 22 year old and one of the decent brokerage Firm in India. In Share Shoppe, we have deployed a team of IIT Delhi alumni along with Chartered Accountants and Stock, commodity and currency market veterans. This mix of academia would ensure decent likely trading and back office Platform, clear services and innovative recommend like never before. With exponentially rising internet penetration and network reliability, we feel sooner and easy to use online trading platforms are the future of Indian monetary markets. We have come up with a hybrid model comprising of older retail broking services and the newer and cheaper online discount brokerage models.

Your blog information is good and useful to the trader........

Stock Market Tips

We give you Crude oil trading tips in mcx/commodity market.

HNI Call in Crude Oil

Epic Research Private Limited is a best option to get expert suggestions and recommendations for stock market and DAILY STOCK TIPS.

Bullion Jackpot Call give you Gold Tips Free Trial and Silver Tips Free Trial in commodity MaRKET.

MCX Tips Free Trial

I haven't been this moved by a blog for a long time! You’ve got it, whatever that means in blogging.

thanks,

Silver Tips Free Trial

very nice and useful information provide.

thansk,

Crude Oil Tips with Single Target

It's a very good post about "If You Missed Google's Run-Up, "Do Buy" Baidu" Thanks for sharing it.............

MCX Sure Shot Tips !!!! 100% Accurate Mcx Commodity Tips

Nice Post about "If You Missed Google's Run-Up, "Do Buy" Baidu"

Thanks,

Commodity Tips Free Trial

thanks for share useful information, we are one of the most leading Digital Marketing Course & Training Institute in Delhi NCR. we provide live project training with our expert team with placement services.

For More : https://ramrajdigital.co.in/

Call Us : +91 – 8130744705 / +91 – 7638845133

Its have a great thoughtful and impressive with few lines

plasma on hire in delhi

hire on led wall in delhi

This is the most supportive blog which I have ever observed. I might want to state, this post will help me a ton to support my positioning on the SERP. Much appreciated for sharing.

https://myseokhazana.com

Nice informative post and for best Intraday Tips tips with great follow up click on the highlighted part day trading tips, Indian Stock Market tips

Stock Market tips

share market tips

Stock tips

share tips

MCX TIPS

indian stock market tips

Intraday tips

trading tips

day trading tips

Great post and it is pleasant to read.

Short Term Investment Tips

Great information shared by you, thanks for the update. if you want to aware of the stock market Get 90% accurate Share Market Tips| Indian Stock Market Tips | MCX Trading , F&O , Nifty Intraday Tips for daily Profit!!! For Free trial give a Missed Call at 083 0211 0055.

This is very great post and i am inspired with your content.

Best Datawebster Services

Hello everyone, Are you looking for a professional trader, cryptocurrency/forex and binary manager who will help you trade and manager your account with good and massive amount of profit in return. you can contact Mr. Bernie for your investment plan, for he helped me earned $8,600 usd with little investment of $850 usd. Mr Bernie Doran you're the best trader I can recommend for anyone who wants to invest and trade with a genuine trader, he also helps in recovery of loss funds..you can contact him on his whatsapp: +1(424)285-0682 Email:(berniedoransignals@gmail.com)I advice you shouldn't hesitate He's great.

Post a Comment

<< Home