From Video Gaming to Learning: Thinking Outside the Game Box

Image credit

Image creditWith the international launch of Sony's PlayStation 3 and Nintendo's Wii in recent weeks, the seventh generation of video gaming has kicked into high gear. To adopt a baseball analogy: following Microsoft's launch of Xbox 360 a year ago in the top of the seventh inning, and months of anticipation this year through the game console industry's "seventh inning stretch," we now move into the bottom of the seventh with the PS3 and Wii launched and production levels rising to meet pent-up consumer demand. Among these three gaming industry titans--Nintendo (TSE: 7974, OTC: NTDOY.PK) , Sony (TSE: 6758, NYSE: SNE) and Microsoft (Nasdaq: MSFT)--which is best positioned to win market share in 2007 and beyond?

Brief Review of Sales History

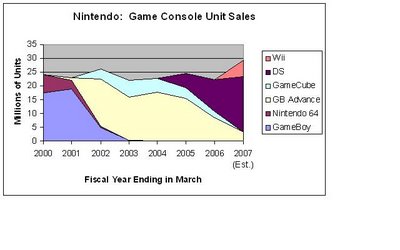

Starting with Nintendo, let's go back in time a product cycle or two and review the competitive landscape (data for figure to the right come from financial reports on Nintendo's website).

Back in the year 2000, sales of the fifth generation devices, Nintendo 64 (launched in 1996) and GameBoy Color (launched in 1998), were still going strong. In 2001, Nintendo entered the sixth generation with launch of both the GameCube console and the GameBoy Advance handheld. Over the next five years, GameCube's cumulative worldwide sales (21 million units) fell dramatically short of Sony's PS2 (106 million units) and even underperformed newcomer Microsoft's Xbox (24 million units). Nintendo, however, has had notable success in the handheld area. GameBoy Advance and its upgrade, GameBoy Advance SP (launched in 2003), together have sold 77 million units. The seventh generation handhelds, Nintendo DS (launched in 2004) and DS Lite (launched earlier this year), are proving even more popular, already selling a record 30 million units within the first two years of product launch. Overall, in transitioning from one generation to the next, Nintendo has managed to maintain total annual unit sales in the 23 million to 26 million range between 2000 and 2006. With current sales of the DS and Wii going strong, the company is now anticipating that the DS and Wii will do better than forecast at the end of October.

Back in the year 2000, sales of the fifth generation devices, Nintendo 64 (launched in 1996) and GameBoy Color (launched in 1998), were still going strong. In 2001, Nintendo entered the sixth generation with launch of both the GameCube console and the GameBoy Advance handheld. Over the next five years, GameCube's cumulative worldwide sales (21 million units) fell dramatically short of Sony's PS2 (106 million units) and even underperformed newcomer Microsoft's Xbox (24 million units). Nintendo, however, has had notable success in the handheld area. GameBoy Advance and its upgrade, GameBoy Advance SP (launched in 2003), together have sold 77 million units. The seventh generation handhelds, Nintendo DS (launched in 2004) and DS Lite (launched earlier this year), are proving even more popular, already selling a record 30 million units within the first two years of product launch. Overall, in transitioning from one generation to the next, Nintendo has managed to maintain total annual unit sales in the 23 million to 26 million range between 2000 and 2006. With current sales of the DS and Wii going strong, the company is now anticipating that the DS and Wii will do better than forecast at the end of October. Sales of Sony's game consoles have been more volatile, peaking at 30 million units both in fiscal year 2003 with the PS2, and in fiscal year 2006 on the strength of the handheld, PlayStation Portable (PSP). While cumulative sales of the PS2 have trounced both Nintendo's GameCube and Microsoft's Xbox (see sales figures cited above), Sony's PSP has fizzled, with sales lagging Nintendo's DS. Based on Sony's own forecast, sales of the PS3 through the end of fiscal year 2007 will be insufficient to make up for declines in older generation PS2 and PSP sales, resulting in a year-on-year decline in unit sales totals.

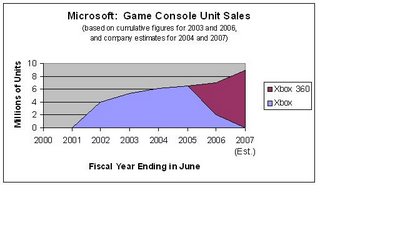

Sales of Sony's game consoles have been more volatile, peaking at 30 million units both in fiscal year 2003 with the PS2, and in fiscal year 2006 on the strength of the handheld, PlayStation Portable (PSP). While cumulative sales of the PS2 have trounced both Nintendo's GameCube and Microsoft's Xbox (see sales figures cited above), Sony's PSP has fizzled, with sales lagging Nintendo's DS. Based on Sony's own forecast, sales of the PS3 through the end of fiscal year 2007 will be insufficient to make up for declines in older generation PS2 and PSP sales, resulting in a year-on-year decline in unit sales totals. Joining the game console war in late 2001 with launch of Xbox, Microsoft has shown consistent year-on-year growth in unit sales. Since its launch at the end of 2005, seventh generation console Xbox 360 has sold over 6 million units, outpacing sales of sixth generation Xbox during its first year post-launch. Microsoft expects sales of Xbox 360 to remain strong during the current holiday season and into 2007. Based on company estimates, we can infer that Xbox 360 should outsell the PS3 and Wii in the short run while the production volumes of the newer consoles are still ramping up.

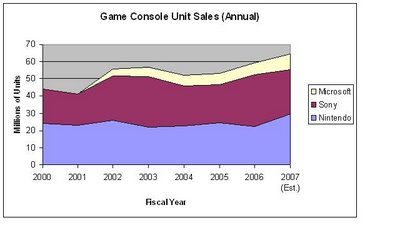

Joining the game console war in late 2001 with launch of Xbox, Microsoft has shown consistent year-on-year growth in unit sales. Since its launch at the end of 2005, seventh generation console Xbox 360 has sold over 6 million units, outpacing sales of sixth generation Xbox during its first year post-launch. Microsoft expects sales of Xbox 360 to remain strong during the current holiday season and into 2007. Based on company estimates, we can infer that Xbox 360 should outsell the PS3 and Wii in the short run while the production volumes of the newer consoles are still ramping up. By layering the sales figures onto the same graph (see diagram to right), we can obtain a composite picture of developing trends. As measured by units sales of the three market leaders, the gaming industry as a whole has grown by about 45% to 50% over the past six or seven years (from 44 million units sold in fiscal year 2000, to a forecast of 64 million units for fiscal year 2007). This secular growth has been driven by a combination of the long-run success of Sony's PS2, Microsoft's growing presence in the gaming arena, and the more recent popularity of Nintendo's DS. On an annualized basis, however, the unit sales growth amounts to a tepid 6% per year, which is rather underwhelming in light of all of the hype and excitement typical of the video gaming industry.

By layering the sales figures onto the same graph (see diagram to right), we can obtain a composite picture of developing trends. As measured by units sales of the three market leaders, the gaming industry as a whole has grown by about 45% to 50% over the past six or seven years (from 44 million units sold in fiscal year 2000, to a forecast of 64 million units for fiscal year 2007). This secular growth has been driven by a combination of the long-run success of Sony's PS2, Microsoft's growing presence in the gaming arena, and the more recent popularity of Nintendo's DS. On an annualized basis, however, the unit sales growth amounts to a tepid 6% per year, which is rather underwhelming in light of all of the hype and excitement typical of the video gaming industry.What to Expect in 2007

PS3, Wii and Xbox 360: With ongoing supply contraints on the PS3 and Wii this holiday shopping season, the Xbox 360 and even the older generation PS2 should continue to do well as substitute gift items for those who need to have something to put under the tree and don't have the time to stand in line for hours to buy the newly released PS3 and Wii game consoles. However, as production of the seventh generation consoles rises heading into 2007, it is likely that hardcore gamers will increasingly choose the PS3 for its superb graphics and speed, and that families and occasional gamers will favor the more affordable Wii for a swing of its enticing motion-sensitive remote controller. Nintendo and Sony are each forecasting sales of 6 million units of their seventh generation consoles by the end of March 2007; however, because the Wii targets a much broader audience than does the PS3, I wouldn't be surprised if the Wii far outsells the PS3 over the next few years.

DS, PSP: Nintendo's DS is likely to continue to outperform Sony's PSP. Exceptionally strong sales of the DS and DS Lite in Japan over the past year indicate that international sales could do better than expected in 2007 as the variety of software titles expands. Nintendo's strategy of appealing to the non-gamer community seems to be working, as evidenced by an increasing percentage of top-selling software titles outside of the traditional action, adventure and role-playing game areas. According to sales on Amazon, about half of the top 25 software titles in Japanese for the DS are on educational topics: cooking skills, common sense and proper manners, Japanese language skills (kanji characters), English language improvement, "brain training," math calculational skills, trivia learning, music creation, and even "how to become a better stock investor." By contrast, currently just four of the top 25 software titles in English (Brain Age, Big Brain Academy, Tetris, and Cooking Mama) cover topics outside of traditional game software areas. Clearly, there remains an opportunity for Nintendo to increase international sales by reaching wider audiences, much as the company has succeeded in doing in Japan.

Will Microsoft Release a Handheld?: This is pure speculation (i.e., I have neither a news source nor inside information here) but I believe it conceivable that Microsoft (headquartered in Redmond, Washington, where Nintendo of America is also located) could release a handheld gaming device to compete with the DS and PSP. In fact, given the tremendous success that Nintendo has had with the DS, it ought to be in Microsoft's best competitive interest to prioritize entry into the handheld market as well. Micrososft launched Xbox years after Nintendo, Sony, Sega and others had pioneered the gaming industry through its initial five generations. Microsoft's recently released portable music player Zune is also very late to the competition with Apple's iPod (Nasdaq: AAPL) and a host of MP3 players offered by SanDisk (Nasdaq: SNDK) and many other companies. Given Microsoft's product history of playing "follow the leader" on the hardware side, a late arrival to the battle for dominance of the handheld gaming device would be right in line with Microsoft's typical modus operandi, wouldn't it?

Is It Time to Buy Nintendo (i.e., the stock)?

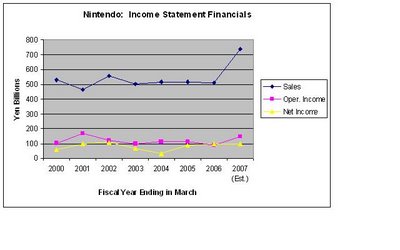

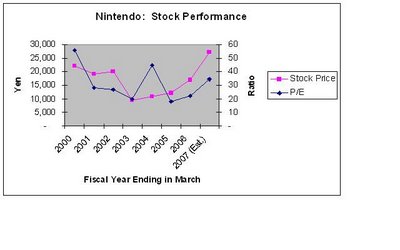

With sales of both the DS and Wii extremely strong and still ramping up, Nintendo's core business fundamentals are now stronger than they have been for at least the past few gaming generations. As the graph to the right indicates, company projections for the fiscal year ending in March 2007 show a surge in sales and profitability. Early sales figures for the DS and Wii suggest ongoing unit sales growth analogous to the multi-year sales expansion Apple's iPod has enjoyed.

With sales of both the DS and Wii extremely strong and still ramping up, Nintendo's core business fundamentals are now stronger than they have been for at least the past few gaming generations. As the graph to the right indicates, company projections for the fiscal year ending in March 2007 show a surge in sales and profitability. Early sales figures for the DS and Wii suggest ongoing unit sales growth analogous to the multi-year sales expansion Apple's iPod has enjoyed. Nintendo's share price has doubled over the past year, reflecting the record-setting sales clip of the DS and anticipating a similarly strong showing for the Wii. As the stock has risen, so has its P/E, currently trading at a multiple of 35 based on forward-looking fiscal year March 2007 earnings. I believe that the stock has excellent upside potential but would wait for either of two events to occur before jumping in to buy: 1) a price pull-back to a forward P/E of below 30, or 2) a solid indication that the DS (or Wii) is likely to become even more broadly used than the market now anticipates.

Nintendo's share price has doubled over the past year, reflecting the record-setting sales clip of the DS and anticipating a similarly strong showing for the Wii. As the stock has risen, so has its P/E, currently trading at a multiple of 35 based on forward-looking fiscal year March 2007 earnings. I believe that the stock has excellent upside potential but would wait for either of two events to occur before jumping in to buy: 1) a price pull-back to a forward P/E of below 30, or 2) a solid indication that the DS (or Wii) is likely to become even more broadly used than the market now anticipates.Applying Video Gaming Technology to Learning

On the second possibility enumerated above: Recall Apple's deliberately grammatically incorrect "Think different" advertising slogan from the late 1990s? Well, speaking of disruptive technology, I think that, even moreso than Apple, it is Nintendo that might really be onto something different. As prominently stated in company president Satoru Iwata's message in Nintendo's 2006 annual report, "the development of games that are more complex and graphically intense has been the focus of game companies for too long. . . . Nintendo has implemented a strategy which encourages people around the world to play video games regardless of their age, gender of cultural background. Our goal is to expand the gaming population." Nintendo's continuing success in executing on its audience-broadening strategy is the not-so-secret formula that can boost the company into the lead in seventh generation hardware and software sales.

Raising the bar still further will involve going beyond gaming as we now know it. If you will, try to imagine our society's future as a global techno-culture. Consider the benefits of more widespread application of gaming devices or their functional equivalents to assist with all types of learning for people of all ages and abilities, though particularly for school-aged children. In my view, the triggering event for an unprecedented expansion of the game-related industry will come when gaming technology becomes an integral part of our educational system. Across the Pacific in Japan, we are already seeing a shift of emphasis towards learning (as opposed to "just for fun" gaming), with housewives, commuting workers and retired people buying practical cooking, language practice and brain fitness software for the DS with such vigor that the titles become bestsellers. There are also a few popular Japanese software titles covering standard academic subjects such as science, history and geography. This trend towards increased usage of gaming devices to run a broad range of educational software is in sharp contrast to the current prohibition of gaming devices in our schools (e.g., a "no electronic equipment" policy bans students from carrying gaming devices, MP3 players and cell phones at my son's middle school in a suburb of Seattle).

I look forward to the day but cannot predict when gaming devices will transition from being prohibited to being required as educational aids in our schools. While we wait, we should view as a "buy signal" any significant introduction of gaming technology into "video learning" pilot programs. By the time the application of gaming hardware and software becomes broad-based, in school as well as out, any alert investor should already own stock in the companies leading the charge. Right now, it's still early days but, if history is any guide, we can expect this new video learning business to be Nintendo's to lead and Microsoft's to follow.

1 Comments:

Good reading your poost

Post a Comment

<< Home