Halloween Spooks: Will Baidu's 2006Q3 Earnings Trick or Treat?

(Spooked by the prospects? Photo credit)

Baidu (BIDU) reports 2006Q3 earnings after the U.S. market close on Halloween (Tuesday, October 31). Analyst consensus estimates indicate $0.26 EPS (on Yahoo Finance; other sources such as Bloomberg and MSN Money show $0.24) on $29.85 million revenue for Q3 (and $0.30 on $35.94 million looking ahead to Q4). In the Q2 earnings release in July, the company gave top line guidance of $30 million to $31 million revenue for Q3 (the company does not provide EPS guidance).

Will Baidu beat or miss, and what's the implication for the stock price?

The Competitive Landscape for Search in China

Let's first glean what we can from what has already been reported for Q3 by Baidu's competitors in the Chinese search market:

Google and Yahoo fail to mention search in China, presumably because the near-term impact on their multi-billion dollar revenue streams is very small, particularly with stagnant or deteriorating market share in China. If these global search market leaders were optimistic about growth prospects in China, don't you think they would be more inclined to mention the opportunity in the conference call? Local player, Sohu, goes into significant detail on search, explaining why their search revenues have declined while their non-search advertising revenues have reached record levels. They express high hopes for launch of the new 3.0 version of their Sogou search engine in 2007. In the course of Q&A, Sohu's management all but admits that, while their own search revenues are shrinking, their competitors continue to grow.

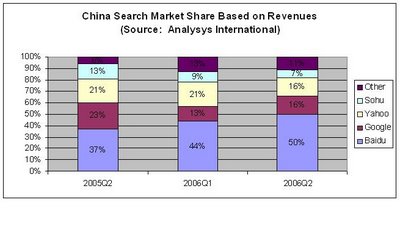

Market research company, Analysys International, perodically releases reports addressing growth trends in China's online advertising market. During the first half of 2006, China's online advertising market grew by 19%, driven by expanding search market revenue. Brand advertising grew a moderate 3% during the first half of the year, while search-related advertising revenues (largely capatured by Baidu) leapfrogged by 72%. Search as a percentage of China's total online advertising revenue rose from 23% in 2005Q4 to 34% in 2006Q2.

As search market revenue has risen, Baidu's share of China's search market has actually accelerated, going from 37% in 2005Q2 to 44% in 2006Q1, and expanding further to 50% in 2006Q2 (see graph). (Incidentally, back in March, Analysys forecast a "sharp slowdown in the coming 18 months" for China's search engine industry, stating that "Poor user experience, unstable advertising effects, and some irregular channel operations make the small and midsize enterprise customers of search engines suspicious of this new kind of advertising." To my knowledge, company reports to date show no sign of an imminent slowdown but, to give Analysys the benefit of the doubt, the 18-month cautionary forecast still has 11 months to run.)

As search market revenue has risen, Baidu's share of China's search market has actually accelerated, going from 37% in 2005Q2 to 44% in 2006Q1, and expanding further to 50% in 2006Q2 (see graph). (Incidentally, back in March, Analysys forecast a "sharp slowdown in the coming 18 months" for China's search engine industry, stating that "Poor user experience, unstable advertising effects, and some irregular channel operations make the small and midsize enterprise customers of search engines suspicious of this new kind of advertising." To my knowledge, company reports to date show no sign of an imminent slowdown but, to give Analysys the benefit of the doubt, the 18-month cautionary forecast still has 11 months to run.)Concurrent with Baidu's growth of search market share, their active online advertiser base has more than doubled to 90,000 customers at the end of 2006Q2, up from 41,000 a year earlier. In last quarter's conference call the company mentioned that most of its 500 to 600 new hires (total company headcount reached 2,300 at the end of 2006Q2) were to be absorbed by their growing direct-marketing sales department. Apparently, management continues to see a huge opportunity to expand their online advertising customer base--no sign of any slowdown here.

The robust momentum underlying Baidu's business appears to be a classic rendition of the network effect: more and more Chinese (particularly the younger crowd) flock to Baidu and its "sticky" search-related properties because that's where everyone else goes, more and more advertisers bid for ad keywords because that's how to reach end-customers for their products and services, and more and more affiliate websites choose to display Baidu's searchbox and toolbar because that's how to partitcipate in the fastest growing and most highly trafficked online advertising network in China.

Anticipating Baidu's 2006Q3 Earnings Release

With Google's global leadership (except in China) and Baidu's rising market share in China, online search is taking on the character of a "holey" (like Swiss cheese) winner-take-all business, with a competitive landscape similar to that of online auctions, where eBay apparently provides the platform in every major market except China and Japan. In the midst of Baidu's expanding search market presence, the performance of competitors in the local Chinese market tends to be counter-indicative of how Baidu's business is going (i.e., when Baidu is doing well, Google, Yahoo and Sohu are probably losing market share). Additional insight into the health of Baidu's business can come from looking beyond the local Chinese search market and examining global search market leader, Google, and the performance of its overall search business.

Fortunately for our analysis, Google typically reports quarterly results one to three weeks prior to Baidu. Since we are concerned with predicting Baidu's earnings and the impact they will have on its stock price, we need to look at how closely market expectations match actual company performance.

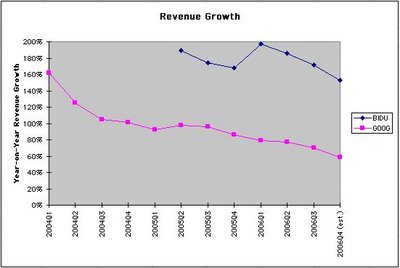

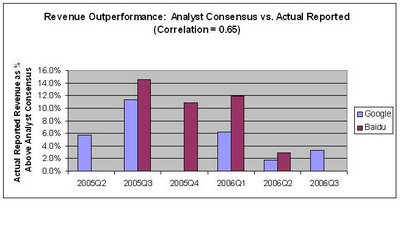

The graph to the right shows the high correlation (running at 0.65 for 2005Q3 to 2006Q2) between the outperformance of Google's and the outperformance of Baidu's reported quarterly revenues versus analyst consensus estimates. In quarters such as 2005Q3 and 2006Q1 when Google blows past consensus expectations, Baidu also tends to outperform very significantly. I believe that this high correlation can be attributed to a number of "collective" factors reaching beyond the inherent similarity of Google's and Baidu's underlying search businesses: the increasing tendency for our global economies to move in tandem, the "herd" instinct of Wall Street analysts and the investor community-at-large, the speed at which innovations (search tools in our case) in one market are soon "copied" in another, etc.

The graph to the right shows the high correlation (running at 0.65 for 2005Q3 to 2006Q2) between the outperformance of Google's and the outperformance of Baidu's reported quarterly revenues versus analyst consensus estimates. In quarters such as 2005Q3 and 2006Q1 when Google blows past consensus expectations, Baidu also tends to outperform very significantly. I believe that this high correlation can be attributed to a number of "collective" factors reaching beyond the inherent similarity of Google's and Baidu's underlying search businesses: the increasing tendency for our global economies to move in tandem, the "herd" instinct of Wall Street analysts and the investor community-at-large, the speed at which innovations (search tools in our case) in one market are soon "copied" in another, etc.Given the high correlation of revenue outperformance of Google and Baidu, we might also expect that stock price movement around earnings release dates of the two companies would be correlated, since earnings news drives stock prices.

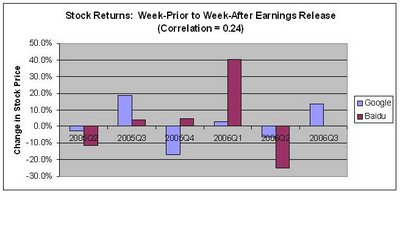

The graph at right shows stock returns for the 10-trading day period from one week prior to earnings release date to one week after, beginning with 2005Q2, the first quarter for which Baidu reported earnings as a public company. There is a noticeable correlation of 0.24 between Google's and Baidu's two-week stock returns around earnings release dates. For example, Google's and Baidu's shares both moved higher around their respective 2006Q1 earnings release dates in April/May, and both faltered around 2006Q2 earnings release dates in July.

The graph at right shows stock returns for the 10-trading day period from one week prior to earnings release date to one week after, beginning with 2005Q2, the first quarter for which Baidu reported earnings as a public company. There is a noticeable correlation of 0.24 between Google's and Baidu's two-week stock returns around earnings release dates. For example, Google's and Baidu's shares both moved higher around their respective 2006Q1 earnings release dates in April/May, and both faltered around 2006Q2 earnings release dates in July.To summarize the logic:

Conclusion: Based on similarities in the companies' underlying search business fundamentals and broader collective market effects, Google's strong Q3 earnings report ($1.87 billion reported revenues vs. $1.81 billion analyst consensus) and resulting share price appreciation (15% run-up to an intraday high of $492 on October 26, one week after the October 19 earnings release) bode well for Baidu's 2006Q3 earnings and resulting stock price performance. Google's Q3 revenue beat the consensus estimate by 3.3%. If Baidu beats by at least a similar percentage (indicating thresholds of $31 million in Q3 revenues vs. $29.85 analyst estimate, and $37 million for Q4 outlook vs. $35.94 analyst estimate), the stock should begin to lift in after-hours trading on Tuesday.

Another benchmark for what's possible in Baidu's Q3 earnings release comes from data on the Chinese market from Nielsen/NetRatings. According to a new study, the size of China's online display advertising market (i.e., the banner ad, non-search portion) was $51 million for the month of September. Combining this with market data from Analysys (cited above), we can infer that China's total online advertising market size was about $77 million (i.e., $51 million/(1 - 0.34)), of which search contributed 34%, or $26 million. Baidu's market share would be about 50% of the search total, or $13 million for September. Applying a month-to-month growth rate consistent with Baidu's reported revenue of $16.9 million for Q1 and $24 million for Q2 to get revenue for July and August, we arrive at a Q3 revenue estimate for Baidu of about $34 million. While this figure is probably too rich (presumably caused by the unintentional vagrancies of combining two disparate data methodologies), it gives us some feel for the extent of market-leader growth that is possible in a rapidly expanding market.

More conservatively, I note that traffic as measured by Alexa has been on the decline in China since the end of the summer for all five Chinese traffic leaders: baidu.com, qq.com (Tencent), sina.com.cn, sohu.com and 163.com (Netease). Alexa's traffic data are sharply at odds with the Nielsen/NetRatings study cited above that shows online display advertising activity (number of campaigns, advertisers and banners) growing at a very rapid clip of about 13% or 14% per month for the period from May through September, for why would more advertisers be running more campaigns displaying so many more banner ads if traffic were actually falling? My guess is that Alexa's traffic statistics, which are full of spurious-looking peaks and valleys, are highly idiosyncratic and more meaningfully employed either for comparing growth of one Web property against another or by averaging over periods of time longer than a few months.

In language appropriate to the season, I would venture to guess that, in the wake of Google's Q3 results, anyone long Baidu (as I am) has odds of about 2/3 of being "treated" versus 1/3 of being "tricked" when Baidu releases earnings after the market close on Halloween. Recalling Baidu's "moonshot" 37% single-day rise following the company's Q1 earnings release on May 9, and shocking 21% single-day fall after the Q2 report on July 26, we should note that Baidu is an extremely volatile stock--one certainly not recommended for the faint of heart.

Whether you happen to be long or short Baidu's shares this Halloween, could anything really be spookier than what Baidu's earnings release portends? Moonshot or cliffhanger? Fear or greed? There's thrilling suspense either way. When Tuesday's closing bell rings and the darker after-hours begin, put on your costume, grab your mask and enjoy the ride!